- Details

- Written by Gordon Prentice

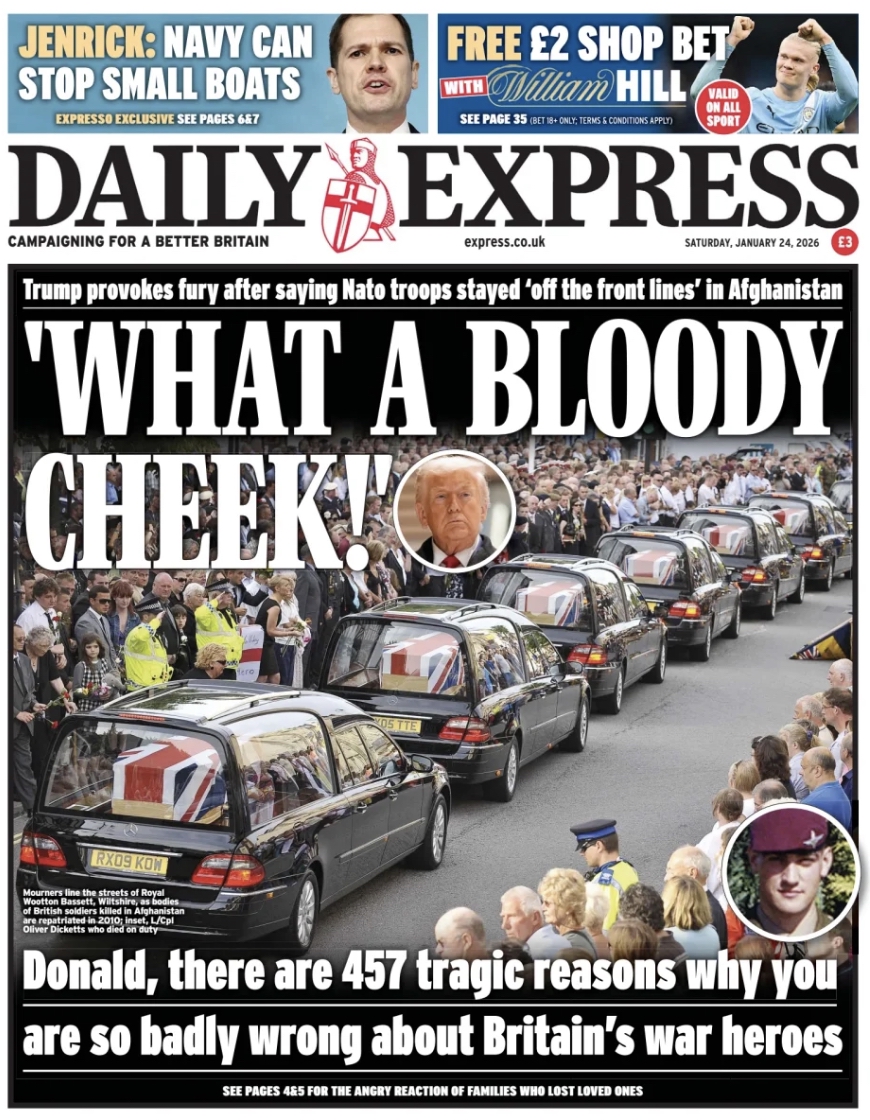

Is there a lower form of pond life than Donald Trump?

I doubt it.

America’s protozoan President plumbed new depths at Davos when he belittled the bravery and sacrifice of NATO troops in Afghanistan who fought alongside the US military. He waved away their contribution as if it didn't matter:

“They stayed a little back, a little off the front lines.”

UK Prime Minister, Keir Starmer, branded Trump’s comments:

“insulting and frankly appalling”

165 Canadian soldiers died in Afghanistan along with 457 from the UK, 44 from Denmark – the most per capita outside the US – and hundreds more from other NATO countries. Thousands were wounded. Many grievously. Australia, outside NATO, sent 40,000 Troops to Afghanistan and lost 47 dead.

America’s Draft-Dodger-in-Chief casually besmirches the memory of the war dead. And moves on to the next controversy.

If Trump had any self-respect he would apologise for his shockingly ignorant remarks. But in a podcast yesterday I heard the disillusioned former Trump supporter, Anthony Scaramucci, say he doesn’t do apologies.

Instead, Trump struts the world stage like some kind of King Emperor, pontificating, beyond criticism.

250th Anniversay of American Independence

King Charles III will be visiting Washington later this year – designed to coincide with the 250th anniversary of American independence. Although no firm date has been announced many commentators believe it will be in late April with the celebrations culminating in a huge Trumpian extravaganza on 4 July 2026.

King Charles III is the Commander in Chief and head of the armed forces of Canada, the UK, Australia, New Zealand and 12 other countries where he is head of state. This role is entrenched in constitutional law but is, of course, symbolic.

But, surely, the King cannot let Trump’s insult pass as if it had never been uttered?

Could anything be more craven than to carry on as before, pretending nothing had happened.

Cancel Visit

The King should withdraw from his planned visit to the United States.

Many years ago when I was an MP at Westminster I recall my old friend, the late Paul Flynn, relentlessly arguing the case that the war in Afghanistan was unwinnable - while all the time paying an unwavering tribute to the heroism and bravery of the British soldiers serving there.

Over a decade ago, he called for a Commons debate on his many Early Day Motions which regularly appeared on the Order Paper, honouring those who fought and died in Afghanistan.

It would be asking too much of Donald Trump to read this long list and reflect upon it.

But we can.

30 October 2014: Paul Flynn: When can we debate early-day motions 409 to 435 which record and honour and express our sorrow at the deaths of the 453 of our brave soldiers killed in Afghanistan?

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Captain Thomas Clarke, aged 30, from Cardiff, Flight Lieutenant Rakesh Chauhan, aged 29, from Birmingham, Warrant Officer Class 2 Spencer Faulkner, aged 38, Corporal James Walters, aged 36, from Cornwall, Lance Corporal Oliver Thomas, aged 26, from Brecon, Sapper Adam Moralee, aged 23, from Newcastle, Captain Richard Holloway, aged 29, from Durham, Warrant Officer Class 2 Ian Fisher, aged 42, from Essex, Lance Corporal James Brynin, The Intelligence Corps, aged 22, from Shoreham-by-Sea, Flight Lieutenant Steven Johnson, aged 38, from Collingham, Nottinghamshire, Flight Lieutenant Leigh Anthony Mitchelmore, aged 28, from Bournemouth, Flight Lieutenant Gareth Rodney Nicholas, aged 40, from Newquay, Cornwall, Flight Lieutenant Allan James Squires, aged 39, from Clatterbridge, Flight Lieutenant Steven Swarbrick, aged 28, from Liverpool, Flight Sergeant Gary Wayne Andrews, aged 48, from Tankerton, Kent, Flight Sergeant Stephen Beattie, aged 42, from Dundee, Flight Sergeant Gerard Martin Bell, aged 48, from Ely, Cambridgeshire, Flight Sergeant Adrian Davies, aged 49, from Amersham, Buckinghamshire, Sergeant Benjamin James Knight, aged 25, from Bridgwater, Sergeant John Joseph Langton, aged 29, from Liverpool, Sergeant Gary Paul Quilliam, aged 42, from Manchester, Corporal Oliver Simon Dicketts, The Parachute Regiment, aged 27, Marine Joseph David Windall, Royal Marines, aged 22, Corporal William Thomas Savage, aged 30, from Irvine, Fusilier Samuel Flint, aged 21, from Blackpool and Private Robert Murray Hetherington, from the United States of America.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Lance Corporal Jamie Webb, 1st Battalion The Mercian Regiment, aged 24, from Wythenshawe, Kingsman David Robert Shaw, 1st Battalion The Duke of Lancaster's Regiment, aged 23, from Barrow-in-Furness, Sapper Richard Reginald Walker, 28 Engineer Regiment, aged 23, from Leeds and Captain Walter Barrie, 1 Scots, aged 41, from Glasgow, Lieutenant Edward Drummond-Baxter, 1st Battalion The Royal Gurkha Rifles, aged 29, from County Durham, Lance Corporal Siddhanta Kunwar, 1st Battalion The Royal Gurkha Rifles, aged 28, from Pokhara, Nepal, Corporal David O'Connor, 40 Commando Royal Marines, aged 27, from Havant, Hampshire, Corporal Channing Day, 3 Medical Regiment, aged 25, from Newtownards, County Down, Captain Carl Manley, Royal Marines, aged 41, Captain James Anthony Townley, Corps of Royal Engineers, aged 29, from Tunbridge Wells, Sergeant Jonathan Eric Kups, Royal Electrical and Mechanical Engineers, aged 38, from Nuneaton, Warwickshire, Sergeant Gareth Thursby, 3 Yorks, aged 29, from Skipton, Private Thomas Wroe, 3 Yorks, aged 18, from Huddersfield, Lance Corporal Duane Groom, 1st Battalion Grenadier Guards, aged 32, from Suva City, Fiji, Sergeant Lee Paul Davidson, The Light Dragoons, aged 32, from Doncaster, and Guardsman Karl Whittle, 1st Battalion Grenadier Guards, aged 22, from Bristol.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Corporal Jack Leslie Stanley, The Queen's Royal Hussars, aged 26, from Bolton, Sergeant Luke Taylor, The Royal Marines, aged 33, from Bournemouth, Lance Corporal Michael Foley, Adjutant General's Corps (Staff and Personnel Support), aged 25, from Burnley, Lancashire, Captain Rupert William Michael Bowers, 2nd Battalion The Mercian Regiment, aged 24, from Wolverhampton, Sergeant Nigel Coupe, 1st Battalion The Duke of Lancaster's Regiment, aged 33, from Lytham St. Annes, Lancashire, Corporal Jake Hartley, 3rd Battalion The Yorkshire Regiment, aged 20, from Dewsbury, West Yorkshire, Private Anthony Frampton, 3rd Battalion The Yorkshire Regiment, aged 20, from Huddersfield, Private Christopher Kershaw, 3rd Battalion The Yorkshire Regiment, aged 19, from Bradford, Private Daniel Wade, 3rd Battalion The Yorkshire Regiment, aged 20, from Warrington, Private Daniel Wilford, 3rd Battalion The Yorkshire Regiment, aged 21, from Huddersfield, Senior Aircraftman Ryan Tomlin, 2 Squadron RAF Regiment, aged 21, from Hemel Hempstead, Lance Corporal Gajbahadur Gurung, Royal Gurkha Rifles, aged 26, from Majthana, Nepal, Signaller Ian Gerard Sartorius-Jones, 20th Armoured Brigade Headquarters and Signal Squadran (200), aged 21, from Runcorn, Cheshire, Rifleman Sachin Limbu, 1st Battalion The Royal Gurkha Rifles, aged 23, from Rajghat, Morang, Nepal, Private John King, 1st Battalion The Yorkshire Regiment, aged 19, from Darlington, Squadron Leader Anthony Downing, Royal Air Force, aged 34, from Kent and Captain Tom Jennings, Royal Marines, aged 29.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Guardsman Jamie Shadrake, 1st Battalion Grenadier Guards, aged 20, from Wrexham, Wales, Lance Corporal Matthew David Smith, Corps of Royal Engineers, aged 26, from Aldershot, Lieutenant Andrew Robert Chesterman, 3rd Battalion The Rifles, aged 26, from Guildford, Warrant Officer Class 2 Leonard Perran Thomas, Royal Corps of Signals, aged 44, from Ross-on-Wye, Guardsman Craig Andrew Roderick, 1st Battalion Welsh Guards, aged 22, from Cardiff, Guardsman Apete Saunikalou Ratumaiyale Tuisovurua, 1st Battalion Welsh Guards, aged 28, from Fiji, Corporal Alex Guy, 1st Battalion The Royal Anglian Regiment, aged 37, from St Neots, Cambridgeshire, Lance Corporal James Ashworth, 1st Battalion Grenadier Guards, aged 23, from Kettering, Private Gregg Thomas Stone, 3rd Battalion The Yorkshire Regiment, aged 20, from Yorkshire, Corporal Michael John Thacker, 1st Battalion The Royal Welsh, aged 27, from Swindon, Wiltshire, Captain Stephen James Healey, 1st Battalion The Royal Welsh, aged 29, from Cardiff, Corporal Brent John McCarthy, Royal Air Force, aged 25, from Priorslee, Telford, Lance Corporal Lee Thomas Davies, 1st Battalion Welsh Guards, aged 27, from Carmarthen, Corporal Andrew Steven Roberts, 23 Pioneer Regiment, The Royal Logistic Corps, aged 32, from Middlesbrough, Private Ratu Manasa Silibaravi, 23 Pioneer Regiment, The Royal Logistic Corps, aged 32, from Fiji, Guardsman Michael Roland, 1st Battalion Grenadier Guards, aged 22, from Worthing and Sapper Connor Ray, 33 Engineer Regiment (Explosive Ordnance Disposal), aged 21, from Newport.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Sapper Elijah Bond, 35 Engineer Regiment Royal Engineers, aged 24, from St Austell, Rifleman Sheldon Lee Jordan Steel, 5th Battalion The Rifles, aged 20, from Leeds, Private Thomas Christopher Lake, 1st Battalion The Princess of Wales's Royal Regiment, aged 29, from Watford, Lieutenant David Boyce, 1st The Queen's Dragoon Guards, aged 25, from Welwyn Garden City, Hertfordshire, Lance Corporal Richard Scanlon, 1st The Queen's Dragoons Guards, aged 31, from Rhymney, Gwent, Lance Corporal Peter Eustace, 2nd Battalion The Riffle, aged 25, from Liverpool, Private Matthew Thornton, 4th Battalion The Yorkshire Regiment, aged 28, from Barnsley, Private Matthew James Sean Haseldin, 2nd Battalion The Mercia Regiment, aged 21, from Settle, Yorkshire, Rifleman Vijay Rai, 2nd Battalion The Royal Gurkha Rifles, aged 21, from the Bhojpur District, Deaurali East of Nepal, Marine David Fairbrother, Kilo Company, 42 Commando Royal Marines, aged 24, from Blackburn, Lance Corporal Jonathan James McKinley, 1st Battalion The Rifles, aged 33, from Darlington, County Durham, Sergeant Barry John Weston, Kilo Company, 42 Commando Royal Marines, aged 40, from Reading, Lieutenant Daniel John Clack, 1st Battalion The Rifles, aged 24, from North London, Marine James Robert Wright, 42 Commando Royal Marines, aged 22, from Weymouth and Corporal Mark Anthony Palin, 1st Battalion The Rifles, aged 32, from Plymouth.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Lance Corporal Paul Watkins, 9th/12th Royal Lancers (Prince of Wales's), aged 24, from Port Elizabeth, Republic of South Africa, Highlander Scott McLaren, The Highlanders 4th Battalion the Royal Regiment of Scotland, aged 20, from Edinburgh, Private Gareth Leslie William Bellingham, 3rd Battalion The Mercian Regiment (Stafford), aged 22, from Stoke-on-Trent, Corporal Lloyd Newell, The Parachute Regiment, Craftsman Andrew Found, Royal Electrical and Mechanical Engineers, aged 27, from Whitby, Rifleman Martin Jon Lamb, 1st Battalion the Rifles, aged 27, from Gloucester, Lance Corporal Martin Joseph Gill, 42 Commando Royal Marines, aged 22, from Nottingham, Corporal Michael John Pike, The Highlanders 4th Battalion The Royal Regiment of Scotland, aged 26, from Huntly, Scotland, Lieutenant Oliver Richard Augustin, Juliet Company, 42 Commando Royal Marines, aged 23, from Kent, Marine Samuel Giles William Alexander MC, Juliet Company, 42 Commando Royal Marines, aged 28, from London, Colour Sergeant Kevin Charles Fortuna, A Company, 1st Battalion The Rifles, aged 36, from Cheltenham, Marine Nigel Dean Mead, 42 Commando Royal Marines, aged 19, from Carmarthen, Captain Lisa Jade Head, 11 EOD Regiment RLC, aged 29, from Huddersfield, Colour Sergeant Alan Cameron, 1st Battalion Scots Guards, aged 42, from Livingston, Scotland, Major Matthew James Collins, 1st Battalion Irish Guards, aged 38, from Backwell, Somerset and Lance Sergeant Mark Terence Burgan, 1st Battalion Irish Guards, aged 28, from Liverpool.]

[That this House That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Private Daniel Steven Prior, 2nd Battalion The Parachute Regiment, aged 27, from Peacehaven, East Sussex, Lance Corporal McKee, 1st Battalion The Royal Irish Regiment, aged 27, from Banbridge, County Down, Northern Ireland, Lance Corporal Liam Richard Tasker, Royal Army Veterinary Corps, aged 26, from Kirkcaldy, Fife, Scotland, Private Robert Wood, 17 Port and Maritime Regiment Royal Logistic Corps, aged 28, from Hampshire, Private Dean Hutchinson, 9 Regiment The Royal Logistic Corps, aged 23, from Wiltshire, Lance Corporal Kyle Cleet Marshall, 2nd Battalion The Parachute Regiment, aged 23, from Newcastle, Private Lewis Hendry, 3rd Battalion The Parachute Regiment, aged 20, from Norwich, Private Conrad Lewis, 4th Battalion The Parachute Regiment, aged 22, from Bournemouth, Warrant Officer Class 2 (Company Sergeant Major) Colin Beckett, 3rd Battalion The Parachute Regiment, aged 36, from Peterborough, Ranger David Dalzell, 1st Battalion, The Royal Irish Regiment, aged 20, from Bangor County Down, Private Martin Simon George Bell, 2nd Battalion The Parachute Regiment, aged 24, from Bradford, Private Joseva Saqanagonedau Vatubua, 5th Battalion The Royal Regiment of Scotland, aged 24, from Suva, Fiji, Warrant Officer Class 2 Charles Henry Wood, 23 Pioneer Regiment Royal Logistic Corps, serving with the Counter-Improvised Explosive Device Taks Force, aged 34, from Middlesbrough, and Corporal Steven Thomas Dunn, 216 (Parachute) Signal Squadron, attached to 2nd Battalion The Parachute Regiment Battlegroup, aged 27, from Gateshead.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Private John Howard, 3rd Battalion The Parachute Regiment, aged 23, from Wellington, New Zealand, Guardsman Christopher Davies, 1st Battalion Irish Guards, aged 22, from St Helens, Merseyside, Ranger Aaron McCormick, 1st Battalion The Royal Irish Regiment, aged 22, from Coleraine in County Londonderry, Senior Aircraftsman Scott ‘Scotty' Hughes, 1 Squadron Royal Air Force Regiment, aged 20, from North Wales, Sapper William Bernard Blanchard, 101 (City of London) Engineer Regiment (Explosive Ordnance Disposal), aged 39, from Gosport, Hampshire, Corporal David Barnsdale, 33 Engineer Regiment, aged 24, from Tring, Sergeant Peter Anthony Rayner, 2nd Battalion The Duke of Lancaster's Regiment, aged 34, from Bradford, Rifleman Suraj Gurung, 1st Battalion The Royal Gurkha Rifles, aged 22, from Gorkha in Nepal, Corporal Matthew Thomas, Royal Electrical and Mechanical Engineers, Sergeant Andrew James Jones, Royal Engineers, aged 35, from Newport, South Wales, Trooper Andrew Martin Howarth, The Queen's Royal Lancers, aged 20, from Bournemouth, Kingsman Darren Deady, 2nd Battalion The Duke of Lancaster's Regiment, aged 22, from Bolton, Captain Andrew Griffiths, 2nd Battalion The Duke of Lancaster's Regiment, aged 25, from Richmond, North Yorkshire, Lance Corporal Joseph McFarlane Pool, The Royal Scots Borderers 1st Battalion The Royal Regiment of Scotland, aged 26, from Greenock, and Lance Corporal Jordan Dean Bancroft, 1st Battalion The Duke of Lancaster's Regiment, aged 25, from Burnley.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Sapper Ishwor Gurung, 69 Gurkha Field Squadron, 21 Engineer Regiment, aged 21, from Pokhara, Nepal, Sapper Darren Foster, 21 Engineer Regiment, aged 20, from Carlisle, Rifleman Remand Kulung, 1st Battalion The Mercian Regiment (Cheshire), aged 27, from Nepal, Lietuenant John Charles Sanderson, 1st Battalion The Mercian Regiment (Cheshire), aged 29, from Oklahoma, USA, Marine Adam Brown, 40 Commando Royal Marines, aged 26, from Burtle, near Glastonbury, Lance Sergeant Dale Alanzo McCallum, 1st Battalion Scots Guards, aged 31, from Hanover, Jamaica, Sapper Mark Antony Smith, 36 Engineer Regiment, aged 26, from Swanley, Kent, Corporal Matthew James Stenton, The Royal Dragoon Guards, aged 23, from Wakefield, Lance Corporal Stephen Daniel Monkhouse, 1st Battalion Scots Guards, aged 28, from Greenock, Staff Sergeant Brett George Linley, The Royal Logistic Corps, aged 29, from Birmingham, Sergeant David Thomas Monkhouse, The Royal Dragoon Guards, aged 35, from Aspatria, Cumbria, Senior Aircraftman Kinikki ‘Griff' Griffiths, aged 20, Marine Jonathan David Thomas Crookes, 40 Commando Royal Marines, aged 26, from Birmingham, Marine Matthew Harrison, 40 Commando Royal Marines, aged 23, from Hemel Hempstead, Major James Joshua Bowman, 1st Battalion The Royal Gurkha Rifles, aged 34, from Salisbury, Lieutenant Neal Turkington, 1st Battalion The Royal Gurkha Rifles, aged 26, from Craigavon, and Corporal Arjun Purja Pun, 1st Battalion The Royal Gurkha Rifles, aged 33, from Khibang village Magdi District, Nepal.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Marine David Charles Hart, 40 Commando Royal Marines, aged 23, from Upper Poppleton, North Yorkshire, Bombardier Samuel Joseph Robinson, 5th Regiment Royal Artillery, aged 31, from Carmarthen, Private Thomas Sephton, 1st Battalion The Mercian Regiment, aged 20, from Warrington, Trooper James Anthony Leverett, Royal Dragoon Guards, aged 20, from Sheffield, Corporal Seth Stephens, Royal Marines, Corporal Jamie Kirkpatrick, 101 Engineer Regiment (Explosive Ordnance Disposal), aged 32, from Llanelli, Bombardier Stephen Raymond Gilbert, 4th Regiment Royal Artillery, aged 36, from Topcliffe, North Yorkshire, Colour Sergeant Martyn Horton, 1st Battalion The Mercian Regiment, aged 34, from Runcorn, Lance Corporal David Ramsden, 1st Battalion The Yorkshire Regiment, aged 26, from Leeds, Private Douglas Halliday, 1st Battalion The Mercian Regiment, aged 20, from Wallasey, Merseyside, Private Alex Isaac, 1st Battalion The Mercian Regiment, aged 20, from the Wirral, Sergeant Steven William Darbyshire, 40 Commando Royal Marines, aged 35, from Wigan, Lance Corporal Michael Taylor, Charlie Company, 40 Commando Royal Marines, aged 30, from Rhyl, Marine Paul Warren, 40 Commando Royal Marines, aged 23, from Leyland, Lancashire, Marine Richard Hollington, 40 Commando Royal Marines, aged 23, from Petersfield, Trooper Ashley Smith, Royal Dragoon Guards, aged 21, from York, Corporal Taniela Tolevu Rogoiruwai, aged 32, from Nausori, Fiji, Kingsman Pomipate Tagitaginimoce, aged 29, from Nausori, Fiji, and Marine Steven James Birdsall, 40 Commando Royal Marines, aged 20, from Warrington.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Lance Corporal Andrew Breeze, B (Malta) Company, 1st Battalion The Mercian Regiment (Cheshire), aged 31, from Manchester, Private Jonathan Monk, 2nd Battalion The Princess of Wales's Royal Regiment, aged 25, from London, Lance Bombardier Mark Chandler, 3rd Regiment Royal Horse Artillery, aged 32, from Nailsworth, Gloucestershire, Corporal Terry Webster, 1st Battalion The Mercian Regiment (Cheshire), aged 24, from Chester, Lance Corporal Alan Cochran, 1st Battalion The Mercian Regiment (Cheshire), aged 23, from St Asaph, North Wales, Marine Anthony Dean Hotine, 40 Commando Royal Marines, aged 21, from Warminster, Marine Scott Gregory Taylor, 40 Commando Royal Marines, aged 20, from Buxton, Corporal Stephen Curley, 40 Commando Royal Marines, aged 26, from Exeter, Gunner Zak Cusack, 4th Regiment Royal Artillery, aged 20, from Stoke-on-Trent, Corporal Stephen Walker, 40 Commando Royal Marines, aged 42, from Lisburn, Northern Ireland, Corporal Christopher Lewis Harrison, 40 Commando Royal Marines, aged 26, from Watford, Sapper Daryn Roy, 21 Engineer Regiment, aged 28, from Consett, County Durham, Lance Corporal Barry Buxton, 21 Engineer Regiment, aged 27, from Meir, Stoke-on-Trent, Corporal Harvey Holmes, 1st Battalion The Mercian Regiment, aged 22, from Hyde, Greater Manchester, Fusilier Jonathan Burgess, 1st Battalion The Royal Welsh, aged 20, from Townhill, Swansea, Rifleman Mark Turner, 3rd Battalion The Rifles, aged 21, from Gateshead and Guardsman Michael Sweeney, 1st Battalion Coldstream Guards, aged 19, from Blyth in Northumberland.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Rifleman Daniel Holkham, 3rd Battalion The Rifles, aged 19, from Chatham, Kent, Lance Corporal of Horse Jonathan Woodgate, Household Cavalry Regiment, aged 26, from Lavenham, Suffolk, Sergeant Steven Campbell, 3rd Battalion The Rifles, aged 30, from Durham, Lance Corporal Scott Hardy, 1st Battalion The Royal Anglian Regiment, aged 26, from Chelmsford, Private James Grigg, 1st Battalion The Royal Anglian Regiment, aged 20, from Hartismere, Suffolk, Captain Martin Driver, 1st Battalion The Royal Anglian Regiment, aged 31, from Barnsley, Corporal Stephen Thompson, 1st Battalion The Rifles, aged 31, from Bovey Tracey, Devon, Lance Corporal Tom Keogh, 4th Battalion The Rifles, aged 24, from Paddington, London, Rifleman Liam Maughan, 3rd Battalion The Rifles, aged 18, from Doncaster, Rifleman Jonathan Allott, 3rd Battalion The Rifles, aged 19, from North Shields, Corporal Richard Green, 3rd Battalion The Rifles, aged 23, from Reading, Rifleman Carlo Apolis, 4th Battalion The Rifles, aged 28, from South Africa, Sergeant Paul Fox, 28 Engineer Regiment, aged 34, from St Ives, Rifleman Martin Kinggett, 4th Battalion The Rifles, aged 19, from Dagenham, Senior Aircraftman, Luke Southgate, II Squadron Royal Air Force Regiment, aged 20, from Bury St Edmunds, Lance Sergeant David ‘Davey' Walker, 1st Battalion Scots Guards, aged 36, from Glasgow, Lieutenant Douglas Dalzell, 1st Battalion Goldstream Guards from Berkshire and Sapper Guy Mellors, 36 Engineer Regiment, aged 20, from Coventry.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Kingsman Sean Dawson, 2nd Battalion The Duke of Lancaster's Regiment, aged 19, from Ashton-under-Lyne, Manchester, Rifleman Mark Marshall, 6th Battalion The Rifles, aged 29, from Exeter, Lance Sergeant Dave Greenhalgh, 1st Battalion Grenadier Guards, aged 25, from Ilkeston, Derbyshire, Lance Corporal Darren Hicks, from Mousehole, Cornwall, Warrant Officer Class 2 David Markland, 36 Engineer Regiment, aged 36, from Euxton, Lancashire, Corporal John Moore, The Royal Scots Borderers, 1st Battalion The Royal Regiment of Scotland, aged 22, from Lanarkshire, Private Sean McDonald, The Royal Scots Borderers, 1st Battalion The Royal Regiment of Scotland, aged 26, from Edinburgh, Corporal Liam Riley, 3rd Battalion The Yorkshire Regiment, aged 21, from Sheffield, Lance Corporal Graham Shaw, 3rd Battalion The Yorkshire Regiment, aged 27, from Huddersfield, Lance Corporal Daniel Cooper, 3rd Battalion The Rifles, aged 22, from Hereford, Rifleman Peter Aldridge, 4th Battalion The Rifles, aged 19, Corporal Lee Brownson, 3rd Battalion The Rifles, aged 30, from Bishop Auckland, Rifleman Luke Farmer, 3rd Battalion The Rifles, aged 19, from Pontefract, Captain Daniel Reed, 11 Explosive Ordnance Disposal Regiment, Royal Logistics Corps, aged 32, from Rainham, Kent, Private Robert Hayes, 1st Battalion The Royal Anglian Regiment, aged 19, from Cambridge, Sapper David Watson, 33 Engineer Regiment (Explosive Ordnance Disposal), aged 23, and Rifleman Aidan Howell, 3rd Battalion The Rifles, aged 19, from Sidcup, Kent.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Lance Corporal Tommy Brown, The Parachute Regiment, Lance Corporal Christopher Roney, A Company, 3rd Battalion The Rifles, aged 23, from Sunderland, Lance Corporal Michael David Pritchard, 4th Regiment, Royal Military Police, aged 22, from Maidstone, Corporal Simon Hornby, 2nd Battalion The Duke of Lancaster's Regiment, aged 29, from Liverpool, Lance Corporal David Leslie Kirkness, 3rd Battalion The Rifles, aged 24, from West Yorkshire, Rifleman James Stephen Brown, 3rd Battalion The Rifles, aged 18, from Kent, Lance Corporal Adame Drane, 1st Battalion The Royal Anglian Regiment, aged 23, from Bury St Edmunds, Acting Sergeant John Paxton Amer, 1st Battalion Coldstream Guards, from Sunderland, Sergeant Robert David Loughran-Dickson, 4th Regiment Royal Military Police, aged 33, from Deal, Kent, Corporal Loren Owen Christopher Marlton-Thomas, 33 Engineer Regiment (EOD), aged 28, Rifleman Andrew Ian Fentiman, 7th Battalion The Rifles, aged 23, from Cambridge, Rifleman Samuel John Bassett, 4th Battalion The Rifles, aged 20, from Plymouth, Rifleman Philip Allen, 2 Rifles, aged 20, from Dorset, Sergeant Phillip Scott, 3rd Battalion The Rifles, aged 30, from Malton, Warrant Officer Class 1 Darren Chant, 1st Battalion The Grenadier Guards, aged 40, from Walthamstow, Sergeant Matthew Telford, 1st Battalion The Grenadier Guards, aged 37, from Grimsby, Guardsman James Major, 1st Battalion The Grenadier Guards, aged 18, from Grimsby, and Corporal Steven Boote, Royal Military Police, aged 22, from Birkenhead, Liverpool.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Corporal Nicholas Webster-Smith, Royal Military Police, aged 24, from Glangwili, Staff Sergeant Olaf Sean George Schmid, Royal Logistic Corps, aged 30, from Truro, Corporal Thomas ‘Tam' Mason, the Black Watch, 3rd Battalion the Royal Regiment of Scotland, aged 27, from Rosyth, Corporal James Oakland, Royal Military Police, aged 26, from Manchester, Lance Corporal James Hill, 1st Battalion Coldstream Guards, aged 23, from Redhill, Surrey, Guardsman James Janes, 1st Battalion Grenadier Guards, aged 20, from Brighton, Acting Corporal Marcin Wojtak, 34 Squadron RAF regiment, aged 24, from Leicester, Private James Prosser, 2nd Battalion The Royal Welsh, aged 21, from Cwmbran, Acting Sergeant Michael Lockett MC, 2nd Battalion The Mercian Regiment, from Monifieth in Angus, Acting Sergeant Stuart McGrath, 2nd Battalion, The Rifles, aged 28, from Buckinghamshire, Trooper Brett Hall, 2nd Royal Tank Regiment, aged 21, from Dartmouth, Kingsman Jason Dunn-Bridgeman, 2nd Battalion The Duke of Lancaster's Regiment, aged 20, from Liverpool, Corporal John Harrison, The Parachute Regiment, Private Gavin Elliott, 2nd Battalion The Mercian Regiment, aged 19, from Woodsetts, Worksop, Nottinghamshire, Lance Corporal Richard Brandon, Royal Electrical and Mechanical Engineers, aged 24, from Kidderminster, Sergeant Stuart ‘Gus' Millar, The Black Watch, 3rd Battalion The Royal Regiment of Scotland, aged 40, from Inverness, Private Kevin Elliott, The Black Watch, 3rd Battalion The Royal Regiment of Scotland, aged 24, from Dundee, and Sergeant Lee Andrew Houltram, Royal Marines.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Fusilier Shaun Bush, 2nd Battalion The Royal Regiment of Fusiliers, aged 24, from Warwickshire, Sergeant Paul McAleese, 2nd Battalion The Rifles, aged 29, from Hereford, Private Jonathon Young, 3rd Battalion The Yorkshire Regiment (Duke of Wellington's), aged 18, from Hull, Lance Corporal James Fullarton, 2nd Battalion The Royal Regiment of Fusiliers, aged 24, from Coventry, Fusilier Simon Annis, 2nd Battalion The Royal Regiment of Fusiliers, from Salford, Fusilier Louis Carter, 2nd Battalion The Royal Regiment of Fusiliers, from Nuneaton, Sergeant Simon Valentine, aged 29, from Bedworth, Private Richard Hunt, 2nd Battalion The Royal Welsh, aged 21, from Abergavenny, Captain Mark Hale, 2nd Battalion The Rifles, aged 42, from Bournemouth, Lance Bombardier Matthew Hatton, 40th Regiment Royal Artillery (The Lowland Gunners), aged 23, from Easingwold, North Yorkshire, Rifleman Daniel Wild, 2nd Battalion The Rifles, aged 19, from Hartlepool, Private Jason George Williams, 2nd Battalion The Mercian Regiment, aged 23, from Worcester, Corporal Kevin Mulligan, The Parachute Regiment, aged 26, Lance Corporal Dale Thomas Hopkins, The Parachute Regiment, aged 23, Private Kyle Adams, The Parachute Regiment, aged 21, Craftsman Anthony Lombardi, aged 21, from Scunthorpe, Trooper Phillip Lawrence, Light Dragoons, aged 22, from Birkenhead, Warrant Officer Class 2 Sean Upton, 5th Regiment Royal Artillery, aged 35, from Nottinghamshire and Bombardier Craig Hopson, 40th Regiment Royal Artillery (The Lowland Gunners), aged 24, from Castleford.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Guardsman Christopher King, 1st Battalion Coldstream Guards, aged 20, from Birkenhead, Liverpool, Captain Daniel Shepherd, 11 Explosive Ordnance Disposal Regiment, The Royal Logistic Corps, aged 28, from Lincoln, Corporal Joseph Etchells, 2nd Battalion The Royal Regiment of Fusiliers, aged 22, from Mossley, Rifleman Aminiasi Toge, 2nd Battalion The Rifles, aged 26, from Suva, Fiji, Corporal Jonathan Horne, 2nd Battalion The Rifles, aged 28, from Walsall, Rifleman William Aldridge, 2nd Battalion The Rifles, aged 18, from Bromyard, Herefordshire, Rifleman James Backhouse, 2nd Battalion The Rifles, aged 18, from Castleford, Yorkshire, Rifleman Joe Murphy, 2nd Battalion The Rifles, aged 18, from Castle Bromwich, Birmingham, Rifleman Daniel Simpson, 2nd Battalion The Rifles, aged 20, from Croydon, Corporal Lee Scott, 2nd Royal Tank Regiment, aged 26, from King's Lynn, Private John Brackpool, 1st Battalion Welsh Guards, aged 27, from Crawley, West Sussex, Rifleman Daniel Hume, 4th Battalion The Rifles, Trooper Christopher Whiteside, The Light Dragoons, aged 20, from Blackpool, Captain Ben Babington-Browne, 22 Engineer Regiment, Royal Engineers, aged 27, from Maidstone, Lance Corporal Dane Elson, 1st Battalion Welsh Guards, aged 22, from Bridgend, Lance Corporal David Dennis, The Light Dragoons, aged 29, from Llanelli, Wales, Private Robert Laws, 2nd Battalion The Mercian Regiment, aged 18, from Bromsgrove, Worcestershire, Lieutenant Colonel Rupert Thorneloe MBE, Commanding Officer, 1st Battalion Welsh Guards and Trooper Joshua Hammond, 2nd Royal Tank Regiment, aged 18.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Major Sean Birchall, 1st Battalion Welsh Guards, aged 33, Lieutenant Paul Mervis, 2nd Battalion The Rifles, aged 27 from London, Private Robert McLaren, The Black Watch, 3rd Battalion The Royal Regiment of Scotland, aged 20 from the Isle of Mull, Rifleman Cyrus Thatcher, 2nd Battalion The Rifles, aged 19 from Reading, Lance Corporal Nigel Moffett, The Light Dragoons, aged 28 from Belfast, Corporal Stephen Bolger, The Parachute Regiment, Lance Corporal Kieron Hill, 2nd Battalion The Mercian Regiment (Worcesters and Foresters), aged 20, from Nottingham, Lance Corporal Robert Martin Richards, Armoured Support Group Royal Marines, aged 24, from Betws-y-Coed, North Wales, Sapper Jordan Rossi, 25 Field Squadron, 38 Engineer Regiment, aged 22 from West Yorkshire, Fusilier Petero ‘Pat' Suesue, 2nd Battalion The Royal Regiment of Fusiliers, aged 28 from Fiji, Marine Jason Mackie, Armoured Support Group Royal Marines, aged 21 from Bampton, Oxfordshire, Lieutenant Mark Evison, 1st Battalion Welsh Guards, Aged 26, Sergeant Ben Ross, 173 Provost Company, 3rd Regiment Royal Military Police, Corporal Kumar Pun, 1st Battalion The Royal Gurkha Rifles, Rifleman Adrian Sheldon, 2 Rifles, from Kirkby-in-Ashfield, Corporal Sean Binnie, 3 Scots, aged 22, Lance Sergeant Tobie Fasfous, 1st Battalion Welsh Guards, aged 29, Corporal Dean Thomas John, Royal Electrical and Mechanical Engineers, aged 25 from Neath, and Corporal Graeme Stiff, Royal Electrical and Mechanical Engineers, aged 24 from Munster, Germany.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Lance Corporal Christopher Harkett, 2nd Battalion The Royal Welsh, aged 22, from Swansea, Marine Michael ‘Mick' Laski, 45 Commando Royal Marines, aged 21, from Liverpool, Corporal Tom Gaden, 1st Battalion The Rifles, aged 24, from Taunton, Lance Corporal Paul Upton, 1st Battalion The Rifles, aged 31, Rifleman Jamie Gunn, 1st Battalion The Rifles, aged 21, from Leamington Spa, Lance Corporal Stephen ‘Schnoz' Kingscott, 1st Battalion The Rifles, aged 22, from Plymouth, Marine Darren ‘Daz' Smith, 45 Commando Royal Marines, aged 27, from Fleetwood, Lancashire, Corporal Daniel ‘Danny' Nield, 1st Battalion The Rifles, aged 31, from Cheltenham, Acting Corporal Richard ‘Robbo' Robinson, 1st Battalion The Rifles, aged 21, from Cornwall, Captain Tom Sawyer, 29 Commando Regiment Royal Artillery, aged 26, from Hertfordshire, Corporal Danny Winter, 45 Commando Royal Marines, aged 28, from Stockport, Marine Travis Mackin, Communications Squadron United Kingdom Landing Force Command Support Group, aged 22, from Plymouth, Sergeant Chris Reed, 6th Battalion The Rifles, aged 25, from Plymouth, Corporal Liam Elms, RM, 45 Commando Royal Marines, aged 26, from Wigan, Lance Corporal Benjamin Whatley, 42 Commando Royal Marines, aged 20, from King's Lynn, Corporal Robert Deering, Commando Logistic Regiment Royal Marines, aged 33, from Solihull, Rifleman Stuart Nash, 1st Battalion The Rifles, aged 21, from Sydney, Australia, and Lieutenant Aaron Lewis, 29 Commando Regiment Royal Artillery, aged 26, from Essex.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Lance Corporal Steven ‘Jamie' Fellows, 45 Commando Royal Marines, aged 28, from Sheffield, Marine Damian Davies, aged 27, Sergeant John Manuel, aged 38, from North East England, Corporal Mark Birch, aged 26, from Northampton, Marine Tony Evans, aged 20, from Sunderland, Marine Georgie Sparks, aged 19, from Epping, Marine Alexander Lucas, 45 Commando Royal Marines, aged 24, from Edinburgh, Colour Sergeant Krishnabahadur Dura, 2nd Battalion The Royal Gurkha Rifles, aged 36, from the Lamjung District of Western Nepal, Marine Neil David Dunstan, aged 32, from Bournemouth, Marine Robert Jospeh McKibben, aged 32, from County Mayo, Rifleman Yubraj Rai, 2nd Battalion The Royal Gurkha Rifles, aged 28, from Khotang District, Eastern Nepal, Trooper James Munday, aged 21, from the Birmingham area, Lance Corporal Nicky Matson, 2nd Battalion The Parachute Regiment, aged 26, from Aveley in Essex, Private Jason Lee Rawstron, 2nd Battalion The Parachute Regiment, aged 23, from Lancashire, Warrant officer Class 2 Gary ‘Gaz' O' Donnell GM, 1 Explosive Ordnance Disposal Regiment Royal Logistic Corps, aged 40, from Edinburgh, Ranger Justin James Cupples, 1st Battalion The Royal Irish Regiment, aged 29, from County Cavan, Ireland, Corporal Barry Dempsey, The Royal Highland Fusiliers, 2nd Battalion Royal Regiment of Scotland, aged 29, from Ayrshire, Signaller Wayne Bland, 16 Signal Regiment, aged 21, from Leeds and Private Peter Joe Cowton, 2nd Battalion The Parachute Regiment, aged 25, from Basingstoke.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Sergeant Jonathan Mathews, The Highlanders, 4th Battalion The Royal Regiment of Scotland, aged 35, from Edinburgh, Lance Corporal Kenneth Michael Rowe, Royal Army Veterinary Corps, aged 24, from Newcastle, Corporal Jason Stuart Barnes, Royal Electrical and Mechanical Engineers, aged 25, from Exeter, Lance Corporal James Johnson, B Company, 5th Battalion The Royal Regiment of Scotland, aged 31, from Scotland, Warrant Officer 2nd Class Dan Shirley, Air Assault Support Regiment, Royal Logistics Corps, aged 32, from Leicester, Warrant Officer 2nd Class Michael Norman Williams, 2nd Battalion The Parachute Regiment, aged 40, from Cardiff, Private Joe John Whittaker, 4th Battalion The Parachute Regiment, aged 20 from Stratford-upon-Avon, Corporal Sarah Bryant, Intelligence Corps, aged 26, from Liverpool, Corporal Sean Robert Reeve, Royal Signals, aged 28, Lance Corporal Richard Larkin, aged 39, Paul Stout, aged 31, Lance Corporal James Bateman, 2nd Battalion The Parachute Regiment, aged 29, from Staines, Middlesex, Private Jeff Doherty, 2nd Battalion The Parachute Regiment, aged 20, from Southam, Warwickshire, Private Nathan Cuthbertson, 2nd Battalion The Parachute Regiment, aged 19, from Sunderland, Private Daniel Gamble, 2nd Battalion The Parachute Regiment, aged 22, from Uckfield, East Sussex, Private Charles David Murray, 2nd Battalion The Parachute Regiment, aged 19, from Carlisle, and Marine Dale Gostick, 3 Troop Armoured Support Company, Royal Marines, aged 22, from Oxford.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Drummer Thomas Wright, 1st Battalion The Worcestershire and Sherwood Forresters, aged 21, from Ripley, Derbyshire, Guardsman Neil ‘Tony' Downes, 1st Battalion Grenadier Guards, aged 20, from Manchester, Lance Corporal Paul 'Sandy' Sandford, 1st Battalion The Worcestershire and Sherwood Foresters, aged 23, from Nottingham, Corporal Mike Gilyeat, Royal Military Police, aged 28, Corporal Darren Bonner, 1st Battalion The Royal Anglian Regiment, aged 31, from Norfolk, Guardsman Daniel Probyn, 1st Battalion Grenadier Guards, aged 22, from Tipton, Lance Corporal George Russell Davey, 1st Battalion The Royal Anglian Regiment, aged 23, from Suffolk, Guardsman Simon Davison, 1st Battalion Grenadier Guards, aged 22, from Newcastle upon Tyne, Private Chris Gray, A Company 1st Battalion The Royal Anglian Regiment, aged 19, from Leicestershire, Warrant Officer Class 2 Michael ‘Mick' Smith, 29 Commando Regiment Royal Artillery, aged 39, from Liverpool, Marine Benjamin Reddy, 42 Commando Royal Marines, aged 22, from Ascot, Berkshire, Lance Bombardier Ross Clark, aged 25, from South Africa, Lance Bombardier Liam McLaughlin, aged 21, from Lancashire, Marine Scott Summers, 42 Commando Royal Marines, aged 23, from Crawley, East Sussex, Marine Jonathan Holland, 45 Commando Royal Marines, aged 23, from Chorley, Lancashire, Lance Corporal Mathew Ford, 45 Commando Royal Marines, aged 30, from Immingham, Lincolnshire, Marine Thomas Curry 42 Commando Royal Marines, aged 21, from East London and Lance Bombardier James Dwyer, 29 Commando Regiment Royal Artillery, aged 22.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of James Thompson, Trooper Ratu Sakeasi Babakobau, Household Cavalry Regiment, aged 29, from Fiji, Trooper Robert Pearson, The Queen's Royal Lancers Regiment, aged 22, from Grimsby, Senior Aircraftman Graham Livingstone, Royal Air Force Regiment, aged 23, from Glasgow, Senior Aircraftman Gary Thompson, Royal Auxiliary Air Force Regiment, aged 51, from Nottingham, Lieutenant John Thornton, 40 Commando Royal Marines, aged 22, from Ferndown, Marine David Marsh, 40 Commando Royal Marines, aged 23, from Sheffield, Corporal Damian Mulvihill, 40 Commando Royal Marines, aged 32, from Plymouth, Corporal Damian Stephen Lawrence, 2nd Battalion The Yorkshire Regiment (Green Howards), aged 25, from Whitby, Corporal Darryl Gardiner, Royal Electrical and Mechanical Engineers, aged 25, from Salisbury, Wiltshire, Sergeant Lee Johnson, 2nd Battalion The Yorkshire Regiment, aged 33, from Stockton-on-Tees, Trooper Jack Sadler, The Honourable Artillery Company, aged 21, from Exeter, Captain John McDermid, The Royal Highland Fusiliers, 2nd Battalion The Royal Regiment of Scotland, aged 43, from Glasgow, Lance Corporal Jake Alderton, 36 Engineer Regiment, aged 22, from Bexley, Major Alexis Roberts, 1st Battalion The Royal Gurkha Rifles, aged 32, from Kent, Colour Sergeant Phillip Newman, 4th Battalion The Mercian Regiment, aged 36, Private Brian Tunnicliffe, 2nd Battalion The Mercian Regiment (Worcesters and Foresters), aged 33, from Ilkeston, Corporal Ivano Violino, 36 Engineer Regiment, aged 29, from Salford and Sergeant Craig Brelsford, 2nd Battalion The Mercian Regiment, aged 25, from Nottingham.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Private Johan Botha, 2nd Battalion The Mercian Regiment, from South Africa, Private Damian Wright, 2nd Battalion The Mercian Regiment, aged 23, from Mansfield, Private Ben Ford, 2nd Battalion The Mercian Regiment, aged 18, from Chesterfield, Senior Aircraftman Christopher Bridge, C flight, 51 Squadron Royal Air Force Regiment, aged 20, from Sheffield, Private Aaron James McClure, 1st Battalion The Royal Anglian Regiment, aged 19, from Ipswich, Private Robert Graham Foster, 1st Battalion The Royal Anglian Regiment, aged 19, from Harlow, Private John Thrumble, 1st Battalion The Royal Anglian Regiment, aged 21, from Chelmsford, Captain David Hicks, 1st Battalion The Royal Anglian Regiment, aged 26, from Surrey, Private Tony Rawson, 1st Battalion The Royal Anglian Regiment, aged 27, from Dagenham, Essex, Lance Corporal Michael Jones, Royal Marines, aged 26, from Newbald, Yorkshire, Sergeant Barry Keen, 14 Signal Regiment, aged 34, from Gateshead, Guardsman David Atherton, 1st Battalion Grenadier Guards, aged 25, from Manchester, Lance Corporal Alex Hawkins, 1st Battalion The Royal Anglian Regiment, aged 22, from East Dereham, Norfolk, Guardsman Daryl Hickey, 1st Battalion Grenadier Guards, aged 27, from Birmingham, Sergeant Dave Wilkinson, 19 Regiment Royal Artillery, aged 33, from Ashford, Kent and Captain Sean Dolan, 1st Battalion The Worcestershire and Sherwood Foresters, aged 40, from the West Midlands.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Marine Richard J Watson, 42 Commando Royal Marines, aged 23, from Caterham, Surrey, Marine Jonathan Wigley, 45 Commando Royal Marines, aged 21, from Melton Mowbray, Leicestershire, Marine Gary Wright, 45 Commando Royal Marines, aged 22, from Glasgow, Lance Corporal Paul Muirhead, 1 Royal Irish Regiment, aged 29, from Bearley, Warwickshire, Lance Corporal Luke McCulloch, 1 Royal Irish Regiment, aged 21, Corporal Mark William Wright, 3rd Battalion The Parachute Regiment, aged 27, from Edinburgh, Private Craig O'Donnell, The Argyll and Sutherland Highlanders, 5th Battalion The Royal Regiment of Scotland, aged 24, from Clydebank, Flight Lieutenant Steven Johnson, aged 38, from Collingham, Nottinghamshire, Flight Lieutenant Leigh Anthony Mitchelmore, aged 28, from Bournemouth, Flight Lieutenant Gareth Rodney Nicholas, aged 40, from Newquay, Cornwall, Flight Lieutenant Allan James Squires, aged 39, from Clatterbridge, Flight Lieutenant Steven Swarbrick, aged 28, from Liverpool, Flight Sergeant Gary Wayne Andrews, aged 48, from Tankerton, Kent, Flight Sergeant Stephen Beattie, aged 42, from Dundee, Flight Sergeant Gerard Martin Bell, aged 48, from Ely, Cambridgeshire, Flight Sergeant Adrian Davies, aged 49, from Amersham, Buckinghamshire, Sergeant Benjamin James Knight, aged 25, from Bridgwater, Sergeant John Joseph Langton, aged 29, from Liverpool, Sergeant Gary Paul Quilliam, aged 42, from Manchester, Corporal Oliver Simon Dicketts, The Parachute Regiment, aged 27, Marine Joseph David Windall, Royal Marines, aged 22, and Ranger Anare Draiva, 1 Royal Irish Regiment, aged 27, from Fiji.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Lance Corporal Jonathan Peter Hetherington, 14 Signal Regiment (Electronic Warfare), aged 22, from South Wales, Corporal Bryan James Budd, 3rd Battalion The Parachute Regiment, aged 29, from Ripon, Lance Corporal Sean Tansey, The Life Guards, aged 26, from Washington, Tyne and Wear, Private Leigh Reeves, Royal Logistics Corps, aged 25, from Leicester, Private Andrew Barrie Cutts, Air Assault Support Regiment, Royal Logistics Corps, aged 19, from Mansfield, Captain Alex Eida, Royal Horse Artillery, aged 29, from Surrey, Second Lieutenant Ralph Johnson, Household Cavalry Regiment, aged 24, from Windsor, Lance Corporal Ross Nicholls, Blues and Royals, aged 27, from Edinburgh, Private Damien Jackson, 3rd Battalion the Parachute Regiment, aged 19, from South Shields, Tyne and Wear, Corporal Peter Thorpe, Royal Signals, aged 27, from Barrow-in-Furness, Cumbria, Lance Corporal Jabron Hashmi, Intelligence Corps, aged 24, from Birmingham, and Captain David Patton, The Parachute Regiment, aged 38.]

[That this House salutes the bravery of the armed forces who served in Afghanistan and records with sorrow the deaths of Sergeant Paul Bartlett, Royal Marines, aged 35, Captain Jim Phillipson, 7 Parachute Regiment Royal Horse Artillery, aged 29, from St Albans, Hertfordshire, Lance Corporal Peter Edward Craddock, 1st Battalion The Royal Gloucestershire, Berkshire and Wiltshire Regiment, aged 31, Corporal Mark Cridge, 7 Signal Regiment, aged 25, Lance Corporal Steven Sherwood, 1st Battalion The Royal Gloucestershire, Berkshire and Wiltshire Light Infantry, aged 23, from Ross-on-Wye, Herefordshire, Private Jonathan Kitulagoda, The Rifle Volunteers, aged 23, from Clifton, Bedfordshire, Sergeant Robert Busuttil, the Royal Logistic Corps, Corporal John Gregory, the Royal Logistic Corps, and Private Darren John George, the Royal Anglian Regiment.]

This email address is being protected from spambots. You need JavaScript enabled to view it.

Note: Exact figures of fatalities can vary slightly depending on source and time frame covered.

Update Saturday 24 January 2024: Trump backs down on his nauseating claim that British soldiers "stayed back a little".

We need another Trump climb down today for the Canadian soldiers who never came home. And one for all the other NATO countries whose troops served and died in Afghanistan. Trump is truly a loathsome creature.

- Details

- Written by Gordon Prentice

I suspect only a handful of people in Newmarket have ever heard of Robert Jenrick – until today the Shadow Minister of Justice in the UK’s Conservative Party.

But in Britain his defection to the Reform Party, led by the fawning Trump sympathiser, Nigel Farage, is the big political news story of the day.

Jenrick says he won’t resign and trigger a by-election.

He should.

Imploding

The Conservatives - once the UK’s most successful political party if measured by its length of time in office - is now imploding. A growing number of Tory MPs have abandoned the Party and are being welcomed into Reform by Farage, its populist beer swilling, cigarette smoking leader.

Here in Canada we also have regular instances of MPs swapping parties while refusing to face their voters in a by-election to see if they agree with the decision.

In November 2025 Chris d’Entremont the MP for West Nova / Acadie-Annapolis (Nova Scotia) crossed the floor from the Conservatives to the Liberals. He was swiftly followed by Michael Ma — the Conservative MP for Markham–Unionville (Ontario) – who joined the Liberals last month taking Mark Carney within striking distance of getting a majority in the House of Commons.

And, of course, here in Newmarket-Aurora, Belinda Stronach famously crossed the floor to the Liberals in 2005 a year after she had been first elected as the riding’s Conservative MP. (Photo: Belinda and Frank Stronach in 2008)

Party swapping happens all the time. (Even dumped candidates do it.)

Quaint Assumption

The right thing to do, then and now, is to resign and seek a fresh mandate from the voters under your newly acquired Party affiliation.

The fact that defecting MPs cling on without facing the voters rests on a quaint assumption they are elected for their sterling qualities as individuals and not as a result of their Party affiliation.

The practice in Canada mirrors the position in the UK as described in this note from the UK House of Commons Library in 2014:

There are no rules requiring the resignation of an MP who leaves one political party for another. A convention that the Member changing parties does not resign to fight a by-election accords with the arguments of Edmund Burke in the late 18th century. This MP, himself a rebel in a number of policy areas, considered that a Member was a representative rather than a delegate.

Historically, the Commons has acted on the principle that all Members of the House of Commons are individually elected, and voters put a “cross against the name of a candidate”. While decisions on candidates may be affected by their party labels, MPs are free to develop their own arguments once elected, until it is time to face the voters in the next general election.

In the UK in 1872 ballot papers were introduced for Parliamentary elections for the first time showing the names of the candidates along with any descriptions they provided such as their profession. But there was no Party label. Indeed, the Representation of the People Act 1948 explicitly forbade candidates from using Party labels. This was changed in 1969 when the Party name could be included.

Party Labels on Ballot Papers but only from 1970

Here in Canada, it was only in 1970 that a candidate’s Party could appear on the ballot paper.

But we’ve now had 55 years of electing candidates identified by their Party colours or as independents. Personally, I believe the time is long overdue for us to change the law to require a by election when an MP swaps parties and crosses the floor. But this is easier said than done.

In 2011, NDP MP Mathieu Ravignat tried unsuccessfully to amend the Parliament of Canada Act using the Private Member’s Bill route. He explained:

The bill provides that a member's seat in the House of Commons will be vacated and a by-election called for that seat if the member was elected to the House as a member of a political party… However, the seat will not be vacated if the member, having been elected as a member of a political party, chooses to sit as an independent.

Predictably, it was defeated by 181-91. To stand any chance of success the Government would have to bring in its own Bill and I cannot see that happening any time soon.

In the meantime, do we just shrug our shoulders and grin and bear it?

Commons Majority

Would it be OK for the Carney Liberals to get a Commons majority which rests on Conservative defections?

It could happen. Pierre Poilievre's leadership review will be held in Calary at the end of the month and while there won't be a stampede out of the Party (sorry) there could be one or two disgruntled and disaffected Conservative MPs changing sides.

Conservative MPs understand Mark Carney. They find him capable. Like he knows how to run the shop.

Courage

But why can't MPs who defect from one Party to another have the courage of their convictions and resign from the House of Commons and fight a by-election under their new Party banner?

The answer I've heard a million times before is that they haven't changed. Their Party has.

Fair enough.

But what better way to test that proposition than in a by-election?

This email address is being protected from spambots. You need JavaScript enabled to view it.

Update on 18 January 2026 from the UK's Observer newspaper: The Right Can't Unite: the fight to the death between the Tories and Reform

- Details

- Written by Gordon Prentice

America is a mafia state.

No point beating about the bush.

The graphic posted on X on 3 January 2025 by Katie Miller, wife of the Don’s consigliere, Stephen Miller, makes it clear Trump wants Greenland sooner rather than later.

Marco Rubio is scheduled to meet the Danes/Greenlanders on Wednesday (14 January) to make them an offer they can’t refuse.

But what if they say no?

How will Rubio react?

Tyranny

It is as plain as a pikestaff they don’t want to sell. The Greenlanders are content with their centuries long association with Denmark. They probably like their free healthcare from cradle to grave and don’t want to swap it for the American alternative. And they don’t want to be absorbed by a state morphing into tyranny before our very eyes.

If they call Trump’s bluff he will be upset but he has a short attention span and will be distracted by any number of other issues on his plate. The ballroom perhaps.

Over the years the United States has gobbled up millions of acres of land once in the ownership of others. There was the Louisiana purchase from France in 1803; Florida from Spain in 1819; the Gadsden Purchase from Mexico in 1853; Alaska from Russia in 1867 and the Danish West Indies (now the US Virgin Islands) in 1917. And, of course, there was a bid to buy Greenland in 1946 but that went nowhere.

But the Danes and the Greenlanders are resolute. They don’t want to sell whatever the inducements.

Trump told the New York Times that ownership of Greenland was

“psychologically important for me”.

He says the increased presence of Chinese and Russian ships near Greenland prompted him to act. The Danish political daily Politiken says there is absolutely no evidence of this.

EU Membership

I am rather taken by the suggestion from the former Vice Chancellor of Germany, Robert Habeck, that the European Union should offer EU membership to Greenland. I am not entirely sure how that would work in practice but it would certainly send all the right signals to the White House.

I have been wondering what people of Danish origin here in Newmarket feel about this. Unfortunately I don’t know where they are so I can’t have a coffee with them.

Totalitarian

Ideally, they would organise a demonstration outside, say, the Old Town Hall which featured a few years back as a Gilead fertility clinic in the Handmaid’s Tale. That would be a suitable totalitarian backdrop. I’d join them.

The last census in 2021 tells me the Town had 380 people of Danish ethnic or cultural origin. 75 had a knowledge of Danish and 40 had Danish as their mother tongue.

In my head I can hear them say:

Grønland er ikke til salg

Greenland is not for sale.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Update on 14 January 2025 from Politiken: Greenland chooses Denmark, the EU and NATO

- Details

- Written by Gordon Prentice

The RCMP investigation into the Ford Government’s Greenbelt scandal is now well into its third year. Why on earth is it taking so long?

On 24 October 2025, the Toronto Star’s excellent Queen's Park reporter, Robert Benzie, told us:

“…former housing minister Steve Clark, former business minister Kaleed Rasheed, and Clark’s former chief of staff, Ryan Amato — have not been interviewed by police.” (click “read more” below to read the whole piece.)

This long delay in completing the investigation suggests it is very complex. Even so, can't they get a move on?

Fading memories

With the passage of time memories fade. Other things being equal, you want to capture recollections when they are still fresh in the mind. Important details can disappear.

I compiled a timeline of the local Greenbelt controversy beginning in 2019 and running through until 5 November 2024 – over a year ago. So things are getting fuzzy round the edges even for me. And I chronicled the saga in great detail.

I was blogging about the threat to the Greenbelt over seven years ago.

Steve Clark and his reprimand

Since then we’ve had Ford’s policy reversal, the Auditor General’s report and the report of the Integrity Commissioner which admonished the Housing Minister, Steve Clark.

The motion to reprimand Clark as recommended by the Integrity Commissioner sat there on the Order Paper, month after month.

The Ford Government never brought the Commissioner’s recommendation forward for debate and a vote.

The Second Southlake

Greenbelt land on our doorstep in the Municipality of King had been floated as the possible site of a second Southlake – which was planned to be an acute hospital.

Years on, Southlake is still heroically trying to find and finalize the second site it so desperately needs.

By messing around with the Greenbelt Doug Ford and his apologists like Dawn Gallagher Murphy put back the prospect of a much needed second Southlake by years.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Update on 29 December 2025: From the Toronto Star: For one plot of land the Greenbelt scandal rages on...

Click" read more" below for Robert Benzie's article in the Toronto Star.

Read more: Whatever happened to… the RCMP investigation into the Greenbelt scandal?

- Details

- Written by Gordon Prentice

I believe my deputation to the Library Board last night was only the third in 11 years. I told the Board that felt like a big deal to me.

It’s not something people do every day. And I only did it because I couldn’t get a meeting with the Library Chair, Darryl Gray, to discuss with him privately my concerns about library statistics. That was eight months ago. I tried again last month to talk to him one-to-one but my emails didn’t get through.

Broken Portal

The Portal in the Library Website (which is ostensibly for the public to contact the Board) was out of commission for over two months and nobody noticed.

On 30 September 2025 the Chief Executive assured me it had been fixed and it hadn’t. My emails just disappeared into the ether. That’s the background.

I spent a lot of time putting my deputation together. The material is posted here and here.

No Ambushes

When I met my Ward Councillor, Trevor Morrison, earlier this month I stressed I had no wish to ambush the Board or its Chief Executive. So I made sure they all had the paperwork well before the meeting.

So I found it very dispiriting and a bit disheartening that after I finished speaking and invited questions from the Board they all remained silent and expressionless, like Easter Island statues, except for the Board Chair, Darryl Gray.

This is how it went:

Library Chair Darryl Gray: “Any questions from the board to the deputant on what he presented this evening? We also have a staff report that we'll be tabling in a minute for any questions of staff.

Me: “But this is the only time the Board will hear from me…. I spent quite a long time on this, and I would appreciate if anyone has any questions to ask them, and I'll do my best to field them.

No pressure, of course, but this is my chance to respond to any questions you may have."

Darryl Gray: “I have one question. I just want to clarify something. So you attest that Tracy changed the provincial definition of a library card holder.”

Me: “Yes”

Darryl Gray: “She didn't actually change the provincial definition. We're reporting a specific way to the province. And my question is this, what was the provincial response to your email about that?”

Me: “Well, the provincial response is complete gobbledegook by the civil servant, Douglas Davey. He basically said - and this is in the report that the Chief Executive has tabled - he said:

Yes, you can satisfy the active cardholder definition by using your card once in two years, but if you don't use your card, that also satisfies the provincial definition.

Now it's in the report in front of you, and that is quixotic. It is bizarre, and I'm taking it up with the province because it's complete drivel.

But we don't know from the report that the Chief Executive has tabled what the question was that led to that risible answer. We don't know the date that the Chief Executive got in touch with Douglas Davey. We don't know the context.

We've just got this bizarre statement from the civil servant that you can satisfy the provincial definition by using your (library membership) card or not using your card. And as I said, that's just risible.”

Darryl Gray: “Any other questions of the deputant? We'll have the chance to talk about the report. Thank you.”

Newmarket Today covered the story this way.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Page 1 of 287