Tomorrow (29 May) York Region's Chief Planner, Valerie Shuttleworth, and Rick Farrell, General Manager Housing Services, will be giving a presentation to Newmarket's Committee of the Whole on housing initiatives and incentives.

It promises to be a bleak and dispiriting affair.

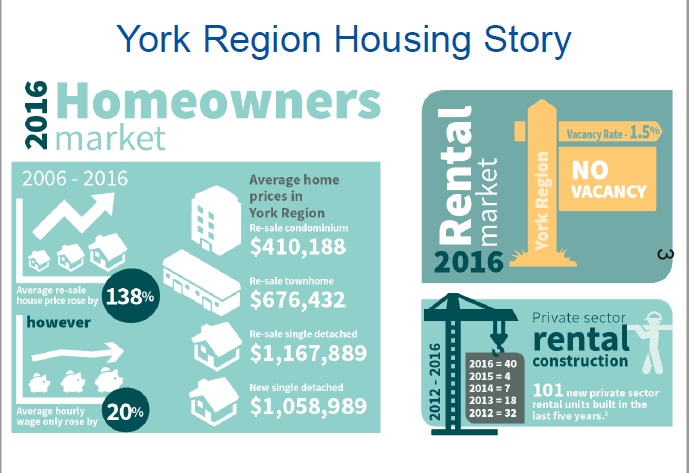

The slide above shows the scale of the problem. In the decade to 2016, the average re-sale house price in York Region rose by 138%. Over the same period, average hourly wages increased by 20%.

In the five years to 2016 there were only 101 new private sector rental units built. Of course, 212 Davis Drive here in Newmarket will add another 200+ units and this is welcome but overall the position is dire.

Ms Shuttleworth has been going round the municipalities delivering her message that York Region can't do it alone. True.

A starting point would be for all of us to acknowledge the scale of the problem.

In Georgina - theoretically one of the more affordable areas in York Region - I read in The Georgina Post (May 10) the median family income (mid-point between the highest and lowest) is approximately $84,000 which caps the home ownership threshold at about $325,000 and there is very little on the market in that price range. I wonder what the equivalent figures are for Newmarket?

Here, relatively modest homes are going for well over a million dollars. This is simply unsustainable. How on earth can local people afford to live here?

The Government has just announced its Fair Housing Plan. It is, I suppose, a step in the right direction but we wait to see how it translates on the ground.

This email address is being protected from spambots. You need JavaScript enabled to view it.

In a recent report, "Understanding the Forces Driving the Shelter Affordability Issue", the Canadian Centre for Economic Analysis tells us:

* 1 in 8 Ontarians are under-housed (i.e., do not have enough bedrooms).

It would take 2.5 years just to supply ‘missing’ bedrooms. But over half of Ontarians (and 3/4 of those aged 65+) are over-housed (i.e., have too many bedrooms). There are over 5m spare bedrooms in Ontario, equivalent to 25 years’ worth of construction. (In fact, there are over 400,000 homes in Ontario that have three or more empty bedrooms - that is, nearly 1.3 million empty bedrooms in family-sized homes.)

* In the GTHA, approximately 45% of housing units are single-detached homes and 35% are in apartment buildings (equal to New York City metro area); only 20% are “missing middle” housing

* 30% of GTHA commuters commute 45+ min. each way. Outside the GTHA is very car dependent – 85% commute by car (5% by transit). In the GTHA, “only” 70% commute by car (20% by transit)

* Since 1990, rental stock per capita has fallen by 1/3 in the GTHA (1/8 outside).

* Over the last 20 years, over 10 times more condo units have been built than purpose-built rental in the GTHA (roughly equal numbers built outside). 1/3 of Toronto’s condos are now rented out.

* Over half of “family-sized” renter households (4+ people) in Ontario are under-housed (far more than owners). 20% of such households (25% in GTHA) are under-housed by multiple bedrooms.

* The rent-to-price ratio in Toronto is lower than every major North American city (except Vancouver and Ottawa), and is much closer to other ‘world class’ cities, suggesting that renting in Toronto could be a good alternative to buying

* An “estimated 95% of all investment properties purchased in 2016 are losing money every month” on the assumption that prices will continue to rise – a sign of speculation, not investment

* “Roughly 17% of homes were resold within 2 years as of March 2016, up from about 9% a year earlier” – a sign of house-flipping

* An estimated 1.5% of the stock in Ontario (or about 85,000 dwellings) is vacant, down from 3% in 2011. This is equivalent to about 1.5 years’ worth of construction. (It is estimated that vacant stock in the GTHA represents a much lower proportion and number)

* Affordability is largely driven by average household size (which is shrinking) and average wages (which are growing, but unevenly). For example, a very small change in average household size (say 2.6 to 2.5) would necessitate a very large increase in housing stock (=3.5 years’ worth of construction)

* Economic prosperity is a huge driver of affordability. Real median family market income has been effectively flat for decades, despite significant real increases in shelter prices