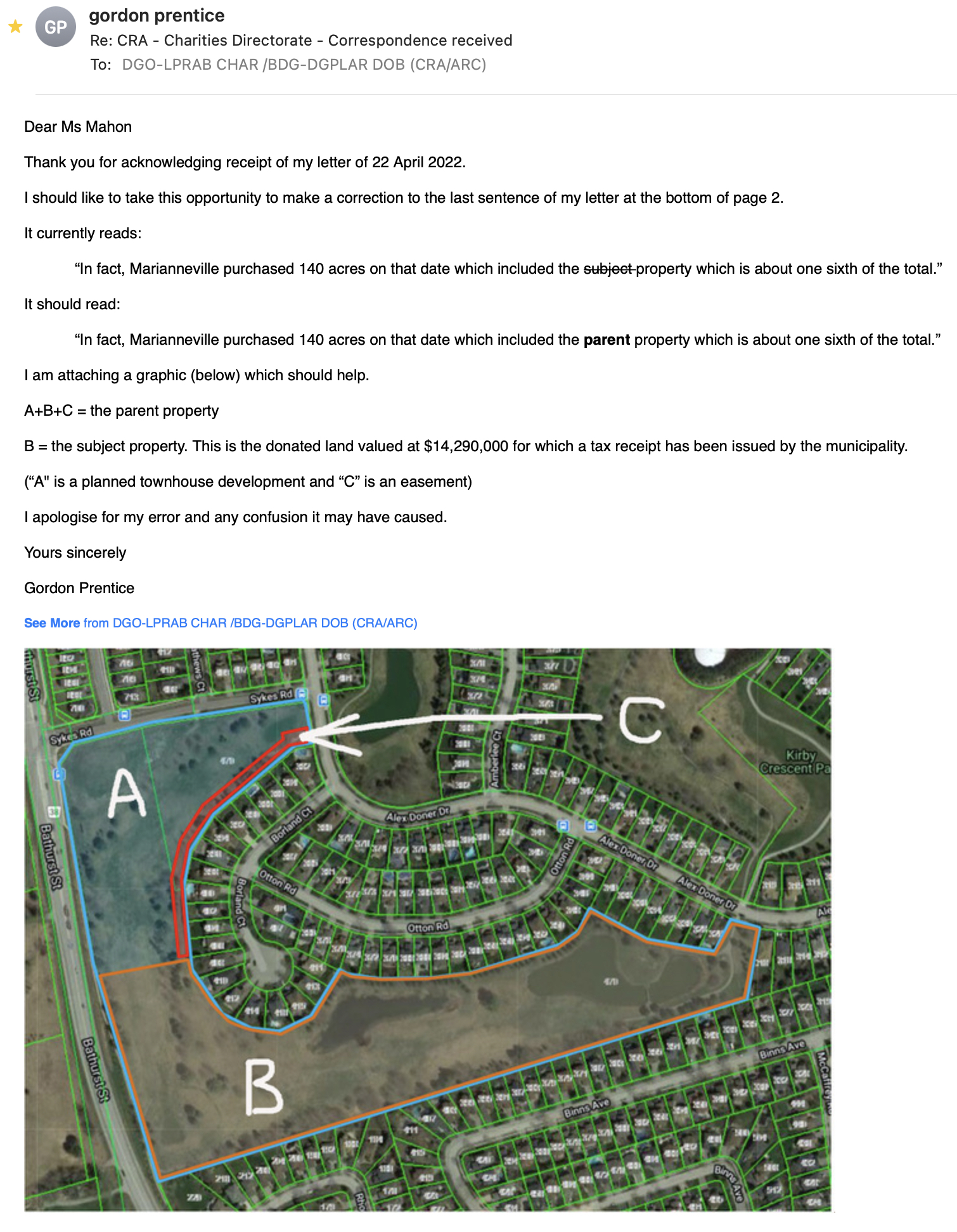

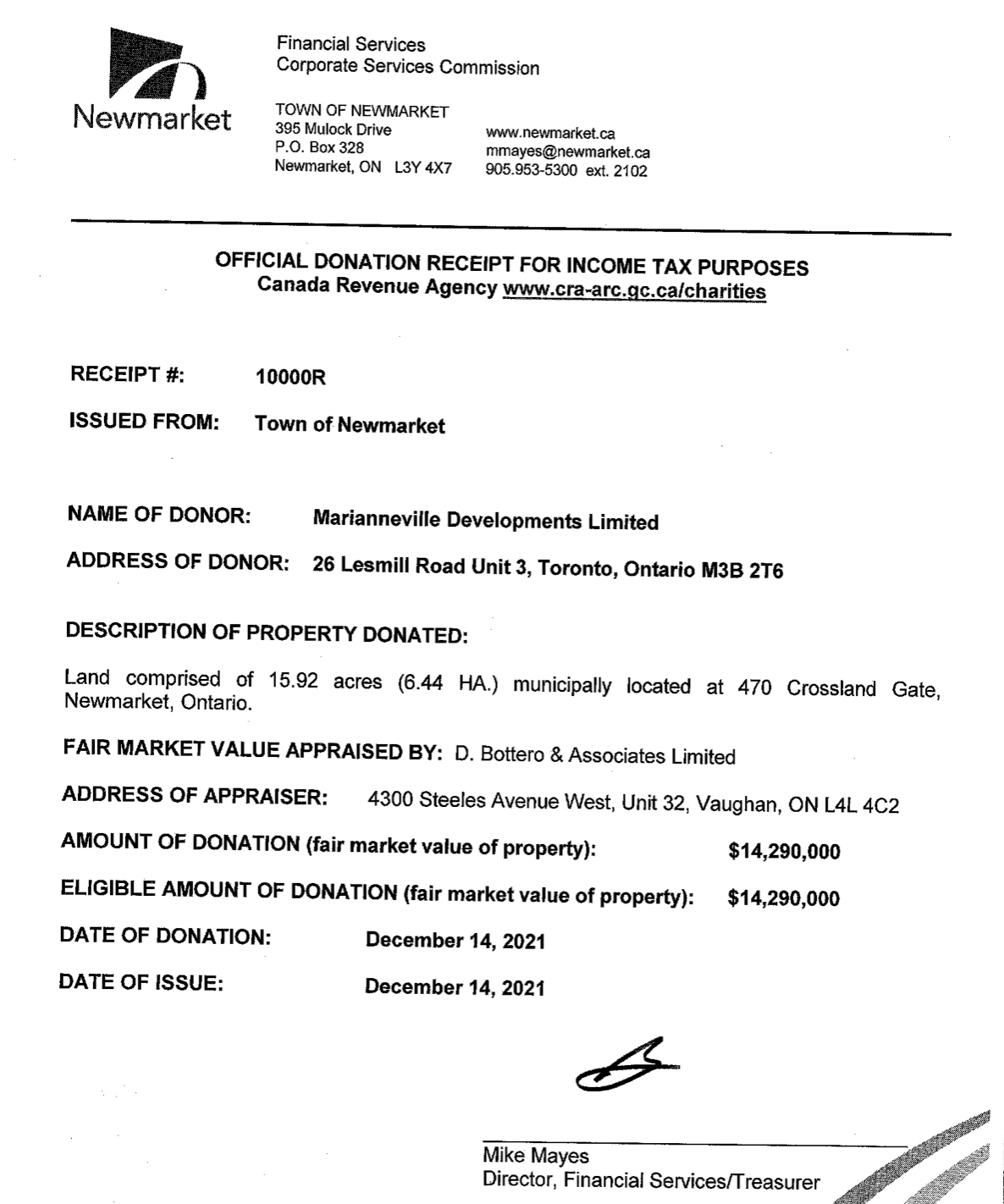

One year ago the Town of Newmarket gave the developer, Marianneville, a tax receipt for $14M in exchange for a donation of land at Glenway West.

To be clear, this $14M is not picked from the pockets of Newmarket taxpayers. It is, rather, a receipt purporting to reflect the value of the donated land which can then be used by the developer to offset tax otherwise owing to the Canada Revenue Agency.

I blogged about it here.

Work of Fiction

The $14M valuation report is a work of fiction based on “extraordinary assumptions” made by the valuer D Bottero & Associates. It assumes two large stormwater ponds can be drained and filled in to allow townhouses to be built on the donated land. I am unaware of any report by the Town’s planners or engineers saying this is feasible or practicable or would otherwise fit in with the Town’s policies.

When I asked the Town’s new Chief Administrative Officer, Ian McDougall, to commission a new valuation on the grounds the original one was flawed he told me on 14 April 2022 he would only do so if directed by the Canada Revenue Agency.

“The Town would not alter the amount on a Tax (or Donation) Receipt that has already been issued without direction from Canada Revenue Agency. Therefore, commissioning a new valuation report would have no practical purpose and would not be an appropriate expenditure of public funds. I will be asking staff to look into other municipalities' experiences in these sorts of donated land situations in order to positively evolve our approach from any best practices identified.”

Canada Revenue Agency

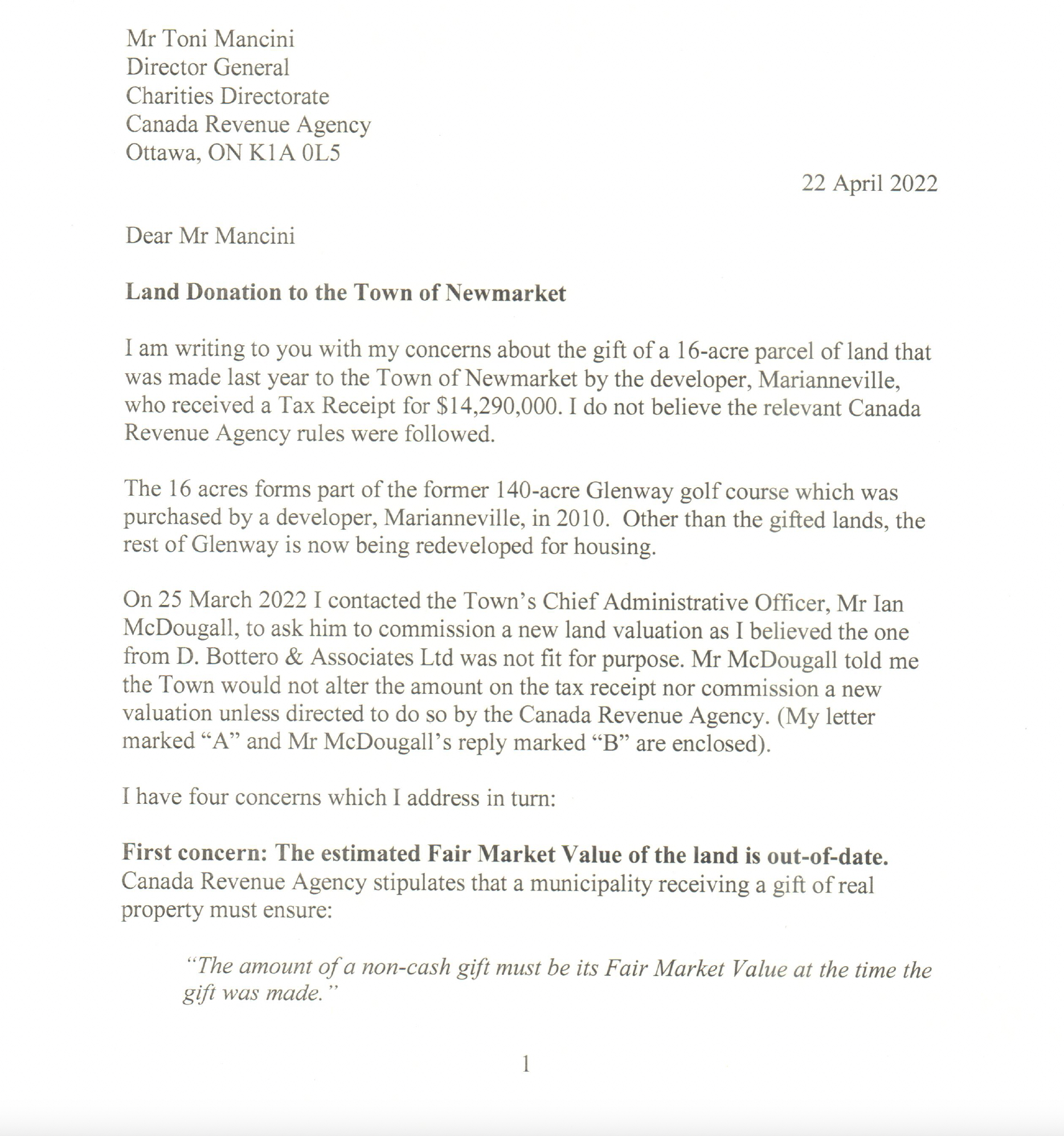

In the light of this I wrote to Toni Mancini, the Director General of the CRA’s Charities Directorate, on 22 April 2022 setting out the issues as I saw them. (For sight of this click “Read More” below).

After chasing them up a couple of times I was eventually told on 17 November 2022 that the CRA does

“not provide feedback or updates once a lead is submitted to us”

and that

“the Charities Directorate’s actions are only made public when they result in a charity being revoked, annulled, suspended or penalised.”

That’s fair enough. There are undoubtedly very good public policy reasons for keeping quiet about CRA investigations. But here we are not talking about the tax affairs of private individuals but rather the process for valuing land and whether the CRA’s own rules were followed. (The CRA stipulates the valuation and donation of land should happen more or less contemporaneously. Here, the so-called “fair market value” was assessed on 26 February 2021 and the tax receipt was issued on 14 December 2021 – an interval of 291 days.)

So, in the absence of any response from the CRA, I am going down the Freedom of Information route again to find out if this sort of thing is commonplace. I am careful not to name names.

Following the rules

I want to know how many times over the past five years the CRA has ordered a new valuation of land donated to a municipality on the grounds that the CRA’s own rules on such charitable donations were not followed.

And I am also curious to know how many municipalities have had their charitable status revoked, annulled or suspended or had suffered some other penalty – again, in each of the last five years.

If this kind of information is not routinely collected by the CRA I won’t get it - unless I am prepared to pay for a tailored search of the records.

And that could cost an arm and a leg.

So, what is the simple answer to this conundrum about estimating the true value of donated land?

I would run the valuer’s “extraordinary assumptions” past the planners and engineers and test them against the Town’s own policies which regulate development.

We may then get a valuation which passes muster.

And not the joke valuation which, for their own very different reasons, the Town and the developer are content to rely on.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Below: Stormwater Pond 3 which the valuation report says can be filled in and the land used for townhouses. No other stormwater ponds in Glenway have been redeveloped in this way.

Note: I received the Bottero report following a Freedom of Information request to the Town of Newmarket. When I asked for it to be posted on the Town’s website I was told this would happen after the appraiser had provided the Town with an accessible PDF as required by the Accessibility for Ontarians with Disabilities Act. It has not yet been posted.