Lord Black of Crossharbour, who renounced his Canadian citizenship to join the House of Lords in 2001, has been on leave of absence from the Lords since 5 September 2017. He has spoken twice in the Lords – the last time over twenty years ago. So why on earth does he want to remain a member of the UK Parliament? And, more to the point, why would the Lords want him back?

Black seems to be happy enough here in Canada, holding forth on the major political issues of the day. He told readers of the National Post on 7 December 2018:

“I do expect to reapply as a Canadian citizen eventually — I have been mainly living here for nearly seven years, have not had so much as a parking ticket and have certainly been a substantial taxpayer.”

Defamation Threat

I can remember the exact date on which I first became intrigued by Conrad Moffat Black and his blustering style. On 24 July 2019 he threatened to sue me for defamation for describing his Lordship as a convicted fraudster – which he is. Personally, I think it an outrage that a convicted felon like Black should still be a member of the Westminster Parliament.

The House of Lords Reform Act 2014 originally proposed that a peer convicted of a serious offence overseas (imprisonment for one year or more) should be automatically disqualified from the Lords - as is the case for a sentence handed down by the Courts in the UK. However, the Bill was later amended to allow the House of Lords to vote on whether disqualification should apply in the case of a conviction overseas.

That said, there is absolutely no doubt in my mind that had Black gone to jail after 14 May 2014 (when the Bill received Royal assent) he would have been expelled from the Lords.

UK Parliament = UK taxes

Since 2010, the Constitutional Reform and Governance Act deems all members of the UK Parliament to be “resident, ordinarily resident and domiciled in the UK for tax purposes”. At the time, Ministers said there was a clear expectation that members of the UK Parliament should pay UK taxes. S41 was the vehicle for doing this, deeming or treating members of Parliament as being UK resident and UK domiciled for tax purposes even if, in reality, they were not UK resident or UK domiciled. In practice, peers can live anywhere they choose, including Canada.

But, not unreasonably, the 2010 Act obliges all members of the UK Parliament to pay UK taxes on their worldwide income. As there is no payroll reference for House of Lords members (because they do not receive a salary for attending, only expenses) it is their responsibility to declare their worldwide income to HMRC (Her Majesty’s Revenue and Customs). There is no absolute requirement for peers to file a tax return. They must do so only if they fulfil the Self-Assessment criteria.

The system is built on trust. HMRC does not keep a record of which members of the House of Lords are non-UK resident and/or non UK domiciled.

This change in the law – obliging UK Members of Parliament to pay UK taxes on their worldwide income - was triggered by my 2007 Freedom of Information request on the tax status of the multi-millionaire Conservative peer, the slippery tax dodger, Lord Ashcroft. On 1 March 2010 Ashcroft admitted for the first time that, throughout his ten-year membership of the Lords, he had been non-domiciled, meaning that he was not paying UK tax on his worldwide income – despite giving a clear and unequivocal assurance in 2000 that he would do so.

Coleman Federal Correctional Facility, Florida.

When the Constitutional Reform and Governance Act became law Conrad Black was serving time in the Coleman Federal Correctional Facility in Florida. He may have been unaware of the Act and how it might affect him. I don’t know. But since then he has pretty much stayed away from Westminster, taking leave of absence from the Lords on 5 September 2017.

From time-to-time Black teases about returning to the Lords. He told his National Post readers on 7 December 2018:

“I have enjoyed it (membership of the House of Lords) and though I have been officially inactive for some years, I have returned and been generously received and look forward to resuming my full active membership.”

We are not told who generously received him. But we do know he has not bothered to apply for an Official Pass (though, quaintly, as a peer he does not actually need one to get into the building).

On 30 May 2019 the BBC reported that, after his “pardon” by Trump, Black was planning a return to the Lords but it all came to nothing.

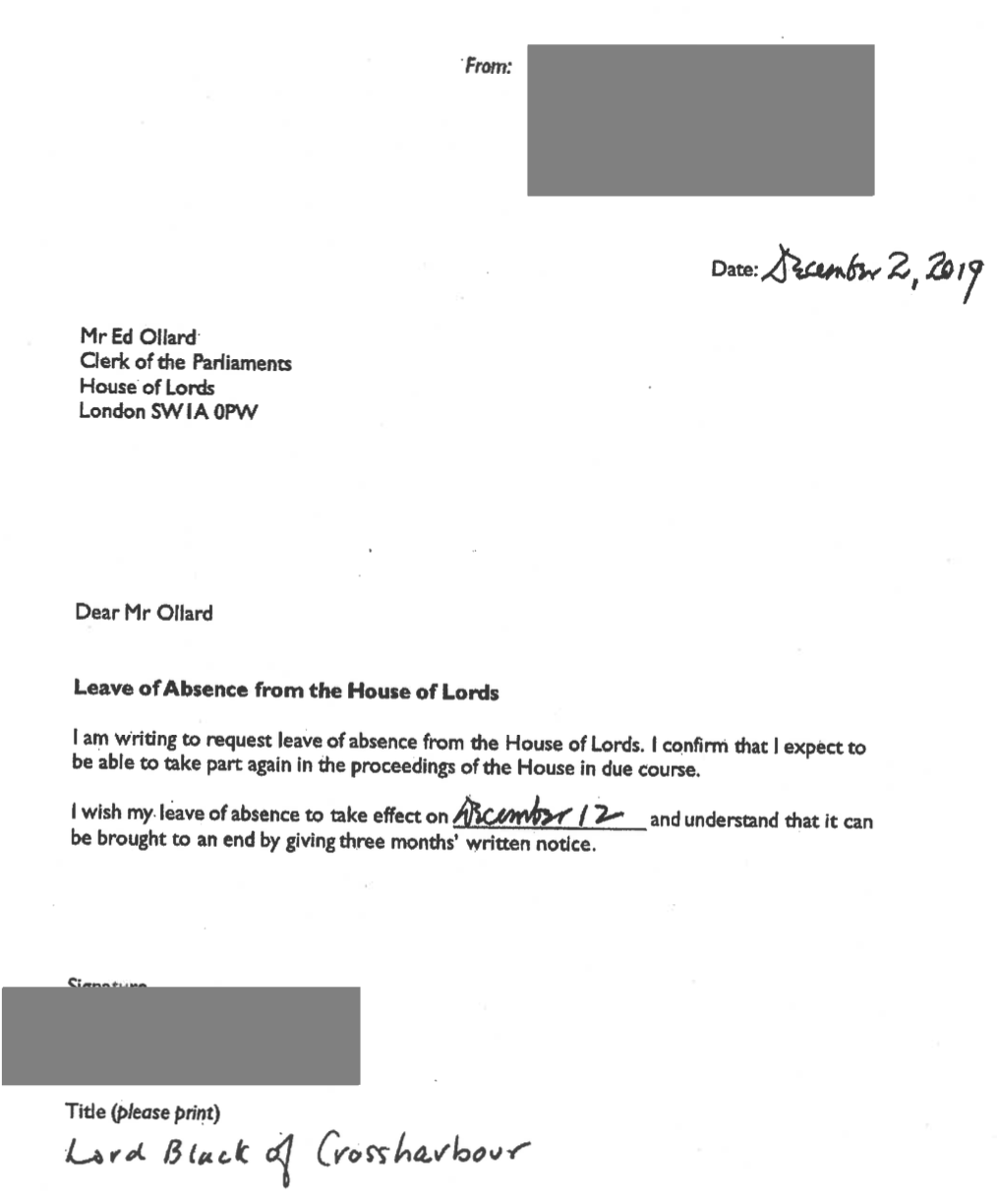

Leave of Absence

At the start of every new Parliament peers are asked if they intend to participate in the work of the Chamber. If, for any reason, they are unable to give that commitment they can (a) resign from the House of Lords or (b) request leave of absence. In the latter case, they tell the Clerk of the Parliaments they are temporarily unable to fulfill their duties as a member but

“expect to be able to take part again in the proceedings of the House in due course”.

This is a notoriously elastic undertaking. However, in recent years the House of Lords Procedure Committee has been quietly closing the loopholes which allow absentee peers like Black to retain their membership of the Lords. (Click "Read More" below for details)

The recent revision of the Lords Standing Orders (February 2021) advises peers that:

“When applying for leave of absence, a member of the House should state in their written application the date by which they expect to return, the reason for their leave of absence and that they have a reasonable expectation that they will be in a position again to take part in the proceedings of the House.”

Sleeping Member

Black, a sleeping member, is totally disengaged from the work of the Lords. He no longer posts an official portrait. He has been inactive for so long that he has been exempt from registering any interests in the Lords Register of Members Interests for more than a decade.

In the light of this, I am left wondering if peers on leave of absence, like Black, have forgotten about the Constitutional Reform and Governance Act 2010 and its requirement that all members of the UK Parliament pay UK taxes on their worldwide income.

Last year I raised this issue with Lord Gardiner of Kimble, the Senior Deputy Speaker who chairs the House of Lords Procedure Committee. He told me that, having reflected on the points I made, he recognised:

“there was a possibility that members of the House may be unaware that Section 41 of the Constitutional Reform and Governance Act 2010 continues to apply when they are on leave of absence’

He told me:

“I think it is important that the House does what it can to ensure all members understand their position on leave of absence, so I am currently exploring options for reminding members going on leave of absence that they must continue to be resident, ordinarily resident and domiciled in the UK for tax purposes. One option is to add such a reminder to the letter sent to members going on leave of absence by the Clerk of the Parliaments. I am taking that forward.”

By the time of the next UK General Election (which could be as far away as January 2025) Conrad Black may well be living in the UK with his wife, Barbara Amiel.

$14,000,000 mortgage

In her brutally frank 2020 memoir “Friends and Enemies” Amiel chronicles the sales of her husband’s London, New York and Palm Beach properties leaving him with his property at 26 Park Lane Circle which she describes as their “Toronto redoubt”. But that, too, has now gone. She recalls Black telling her:

“I’ve held out, but we have to sell this house… We have to get rid of the fourteen-million mortgage plus the million and a half annual running costs.”

She says she knew he was right.

She told the Tatler on 8 October 2021 there was a buy-back agreement on the Toronto mansion they had just left, but she suspects they’ll buy somewhere in the UK. She says they miss London and they miss their friends there.

“I want the world to open up. I want to be able to go to concerts. I, even at this horribly advanced age, want to go to a bar like Annabel’s and canoodle with Conrad in a corner.”

Clearly, Canada’s loss will be Britain’s gain.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Explainer on non-domiciled status: The UK's Guardian newspaper revealed on Wednesday 6 April 2022 that the wife of the UK Chancellor of the Exchequer is non-domiciled. And what the tax experts say.

Conrad Black in the UK at the Cliveden Literary Festival October 2021. Still spinning a tale, he tells his audience:

“The late William F Buckley invited me to become a columnist for the National Review after I had been spuriously convicted as is now universally recognised and… at least it is acknowledged by the U.S. Government anyway…”

Extract from the Standing Orders of the House of Lords

(7A) The House may refuse or end leave of absence on the application of the Commissioner for Standards or the Conduct Committee, where this is necessary either to enable the Commissioner to conduct an investigation under the Code of Conduct, or to enable the Conduct Committee to impose or recommend the imposition of a sanction on a member of the House.