- Details

- Written by Gordon Prentice

I do not know if Conrad Black still lives here in Canada – the country whose citizenship he renounced in 2001 and the one which gave him sanctuary after his release from prison in the United States where he had been convicted of fraud.

However, I know for a fact that Black is a member of the UK Parliament and, as such, is deemed to be resident and domiciled in the UK for tax purposes. Black is currently on leave of absence but the tax rules still apply.

When I recently asked him if he satisfied the requirements for membership of the UK Parliament or if he was there under false pretences he told me:

“Of course I am fully qualified to hold the status I do.”

Guidance

Guidance from Her Majesty’s Revenue and Customs (HMRC) says this:

“Members of the House of Commons (MPs) and House of Lords (Peers) are treated as resident and domiciled in the UK for Income Tax, Inheritance Tax and Capital Gains Tax purposes. This applies to the whole of each tax year in which a person is a member of either House. It applies even if that person is a member for only part of the tax year and regardless of whether or not they are on a leave of absence.” (my underlining)

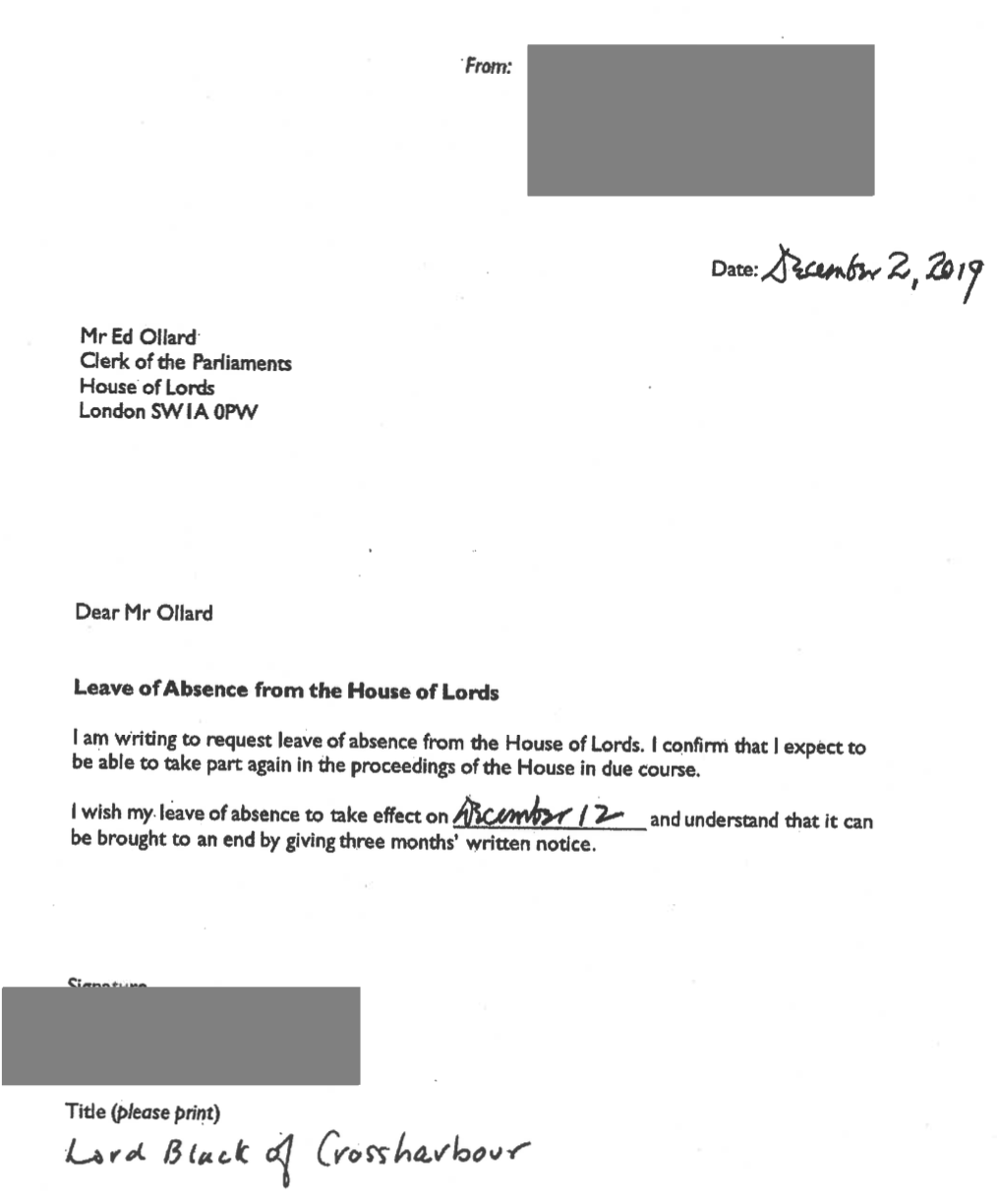

At the start of a new Parliament, the Clerk of the Parliaments writes to peers on leave of absence to ask whether they wish to retire from the House of Lords or whether they plan to attend again but wish to continue their leave of absence in the new Parliament.

I'll be back says Black

On 2 December 2019, Black told the then Clerk of the Parliaments, Ed Ollard, he expected to be able to take part again in the proceedings of the House in due course and wished to stay on leave of absence.

Tax – and especially international taxation - is notoriously complex but, on the face of it, Black should be a UK taxpayer.

As it happens, 13 years ago when I was an MP at Westminster, I introduced the Disqualification from Parliament (Taxation Status) Bill which, unfortunately, failed to make progress. The Government, though, endorsed the general principle that UK Members of Parliament should be expected to pay UK taxes and this was subsequently brought into law with the Constitutional Reform and Governance Act 2010.

Part 4 of the Act provides that Members of Parliament and members of the House of Lords (other than Lords Spiritual) are to be deemed to be resident, ordinarily resident and domiciled in the United Kingdom for the purposes of income tax, capital gains tax and inheritance tax. As a result, MPs and Lords are liable to pay these taxes in the UK on their worldwide income.

That seems clear enough.

Home is where the heart is

Although we must tread carefully through the complexities, it seems HMRC will treat you as UK resident if you spend 183 or more days in the UK in the tax year; have a home in the UK, and do not have a home overseas and work full-time in the UK over a period of 365 days.

Of course, it is not quite so cut and dried. There is now a Statutory Residence Test which takes into account the amount of time you spend in the UK and the connections you have with the UK.

Additionally, we learn:

‘Ordinary residence’ is different from ‘residence’. It is not defined in tax law and is based on cases heard by the Courts. If you’re resident in the UK year after year, this would indicate that you normally live here and you’re therefore ‘ordinarily resident’ here.

As a general rule, HMRC regards you as domiciled in the country where you have your permanent home and

“For the purpose of the Statutory Residence Test we consider that a person’s home is a place that a reasonable onlooker with knowledge of the material facts would regard as that person’s home.”

Is Black here? Or is it a hologram?

I’ve been following Conrad Black’s pronouncements and declamations in the National Post and elsewhere ever since he was released from jail in the United States and I've always taken it as a given that the great man was here amongst us, pontificating in Canada.

Who knows? He wants the UK authorities to believe that all along he has been domiciled in the UK, dutifully paying his taxes to the Exchequer. But, then again, perhaps he has been living here and paying UK taxes!

The House of Lords authorities do not require peers to confirm in writing that they are resident, ordinarily resident and domiciled in the UK for tax purposes. They take it on trust. This is engagingly quaint. But it is also a glaring loophole.

Don't ask. Don't tell

The people who do know - the tax authorities – do not comment on the tax affairs of individuals.

The House of Lords won’t ask. And HM Revenue and Customs won’t tell.

Clearly, the UK Parliamentary authorities should ask peers on leave of absence like Black to confirm in writing that they are UK resident, ordinarily resident and domiciled in the UK for tax purposes and that they fulfil the requirements for membership of the UK legislature.

I wouldn’t take anything on trust from someone with a criminal record.

So why should the UK Parliament?

This email address is being protected from spambots. You need JavaScript enabled to view it.

- Details

- Written by Gordon Prentice

Conrad Black has strong views about the taxes we pay here in Canada but is he a Canadian taxpayer himself?

He should tell us.

Consider this:

Either Lord Black of Crossharbour is UK domiciled for tax purposes - in which case he fulfils a key criterion for membership of the Lords. Being UK domiciled for tax purposes means he pays UK tax on his worldwide income.

Not unreasonably, members of the UK Parliament are expected to pay UK taxes.

Alternatively, he pays tax to the Canada Revenue Agency on his worldwide income in which case he is ineligible for Lords membership.

He cannot have it both ways.

If Black is not paying UK tax he is a lawbreaker and should resign from the Lords immediately.

Leave of Absence

Black took leave of absence from the House of Lords on 5 September 2017.

Importantly, members of the House of Lords – whether they are on leave of absence or not – are deemed to be UK domiciled for tax purposes.

Temporary residence

On his release from prison in the United States in May 2012 Black was given a temporary residence permit by the then Minister of Immigration and Citizenship and now Premier of Alberta, Jason Kenney, allowing him to enter and remain in Canada for one year. He is still here.

Black had renounced his Canadian citizenship in 2001 in order to join the House of Lords. In almost twenty years of membership he made two speeches and had zero impact. His first speech, describing his efforts to get into the Lords, was on 15 May 2002 and his second, on Iraq, was on 28 November 2002.

Privileges of the peerage

Black still has the privileges of the peerage even when on leave of absence. He can dine and use the facilities at Westminster and keep the title. He can sit on the steps of the Throne during debates but he cannot participate or vote. However, he can rejoin by giving three months notice to the Clerk of the Parliaments that he intends to return and become active again.

He says he misses the place and wants to sit in the House of Lords again.

He can.

But only if he pays UK taxes on his worldwide income and zero to the Canada Revenue Agency.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Lord Black lost the Conservative whip in the Lords years ago and is now described as “non-affiliated”.

I have asked his Lordship if he is domiciled in the UK for tax purposes:

Dear Lord Black

I am writing to ask if you satisfy the requirements for membership of the UK Parliament or if you are there under false pretences.

I see from the House of Lords website that you are currently on leave of absence and have been since 5 September 2017.

You will have made it clear to the Clerk of the Parliaments that this leave of absence is temporary and that you are minded to return to the UK at some stage to participate as an active member of the House of Lords.

The Constitutional Reform and Governance Act 2010 provides that members of the House of Commons and House of Lords are deemed resident, ordinarily resident and domiciled in the UK for the purposes of income tax, inheritance tax and capital gains tax.

HM Revenue and Customs makes it clear beyond dispute that this requirement also applies to members of the House of Lords whether or not they are on leave of absence.

Not unreasonably, it is expected that members of the UK Parliament pay UK taxes on their income.

As I see it, you are either UK domiciled for tax purposes - in which case you fulfil a key criterion for membership of the Lords. Or you pay tax to the Canada Revenue Agency on your worldwide income in which case you are ineligible for membership of the House of Lords.

If it is the latter you should resign your membership of the Lords forthwith.

Please let me know if you will do this.

Gordon Prentice

Update at 6.04pm on 20 May 2021: From Lord Black of Crossharbour by email to me: "By what colour of right do you presume to interrogate me?"

Update at 9.23pm on 20 May 2021: From me to Lord Black of Crossharbour: "You did not answer my question. Do you satisfy the requirements for membership of the UK Parliament? This is not a difficult question to answer. A simple yes or no will do."

Update at 9.49pm on 20 May 2021: From Lord Black of Crossharbour to me: "You didn’t answer mine because you have no standing to question me. If memory serves we have been over matters to do with my status as a member of Their Lordships’ House before, and you are belligerent and obnoxious. Of course I am fully qualified to hold the status I do. This is the last time I will give you the undeserved courtesy of a response."

Update at 11.05pm on 20 May 2021: from me to Lord Black of Crossharbour: "You say you are fully qualified to hold the status you do (as a member of the UK Parliament). This means you are UK domiciled for tax purposes and pay UK tax on your worldwide income. UK domicile for tax purposes is a condition of membership of the House of Lords.

Read more: Why Conrad Black must resign from the House of Lords immediately

- Details

- Written by Gordon Prentice

Last September Southlake Regional Medical Centre in Newmarket announced it would be eliminating 97 Registered Nurse positions. The hospital said it was facing a “significant financial challenge’.

Since then 70 Registered Nurses have received lay-off notices but, mercifully, none has been shown the door.

Getting rid of Registered Nurses is hard to explain in normal times but in the middle of a pandemic it would be next to impossible.

But, make no mistake, the threat of redundancy will still hang over the registered nurses when the Covid threat recedes, as it will.

Superheroes

Yesterday Newmarket-Aurora’s Liberal MP, Tony Van Bynen, marked National Nursing Week by telling the House of Commons that nurses are our “superheroes”.

“Mr. Speaker, some heroes wear capes; others wear masks, face shields, gloves and gowns, but all heroes protect our communities by keeping them safe. Since the start of this pandemic, nurses across Canada have been at the front lines in our battle against this virus. Many have been going to work every day in conditions that could pose a threat to their health, and many have been isolating from their families so they could care for ours.”

He tells MPs nurses are the soul of our health service:

“It is important for us to recognize that nurses are the soul of our health care system and have always been so.”

Except, I suppose, when they are being made redundant.

Courage, commitment, compassion, sacrifice (and out of a job)

Van Bynen thanks them for their courage, commitment, compassion and sacrifices.

But will he do anything to save them from being laid-off at Southlake?

Will he say anything about it?

Van Bynen has a national platform. And as a member of the House of Commons Health Committee he has a thousand opportunities to speak out when Registered Nurses in his own constituency are faced with redundancy.

Instead we get the usual bromides.

Newmarket-Aurora's new Liberal MP has not, so far, expressed a view on the threatened lay-offs. He is content to leave it to Southlake's Chief Executive, Arden Crystal.

Why did I expect anything different?

This email address is being protected from spambots. You need JavaScript enabled to view it.

Update on 14 May 2021: From Newmarket Today: Ontario increasing training spaces to add 2,000 nurses to the health care system. See Ontario Press Release here.

- Details

- Written by Gordon Prentice

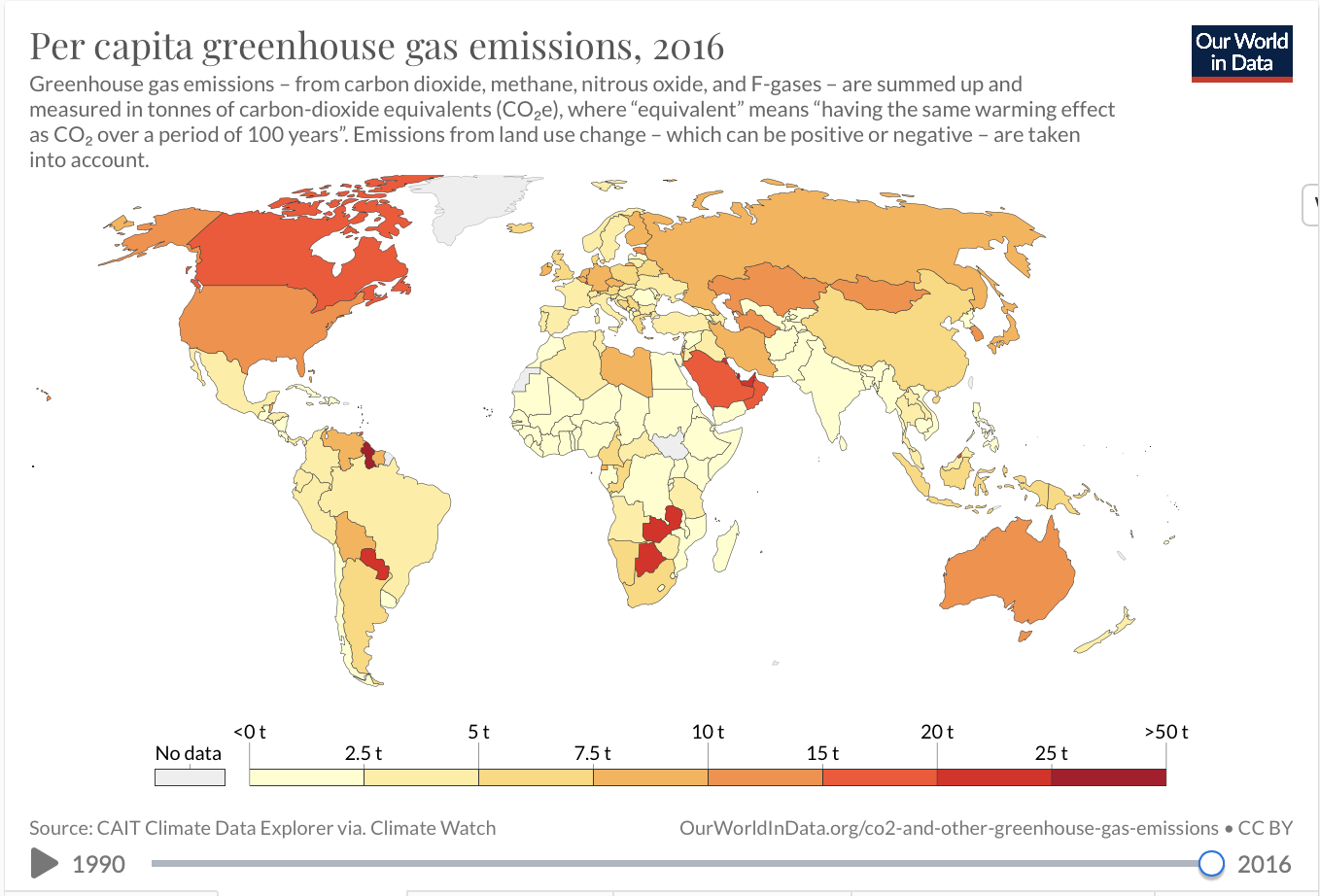

Canada is warming twice as fast as the global average. And in the Canadian North it's three times.

Should we be worried?

I suppose Canadians will sit up and take notice once the permafrost turns squelchy and roads buckle and houses lean over at crazy angles.

But, until then, how do we grab their attention?

Walter Bauer sent me his latest research on Canada’s Greenhouse Gas Emissions (GHG) which got me thinking. Walter reviewed Canada’s two climate plans and the budget (links highlighted below) to see if GHG emissions were likely to reduce to anything near the Paris Agreement which, he admits, is a low bar.

By 2019 Canada’s GHG emissions had gone up to 730 mega-tonnes per year (Mt/year). I find it difficult to visualise this so I ask Walter for help. He tells me:

1 mega-tonne is 1 billion kilograms. An elephant weighs 4,000 kg. 1 mega-tonne equals 250,000 elephants.

Canada is emitting (2019 data) 730Mt of CO2 or 182,500,000 elephants every year.

Our World in Data is a very useful interactive website which allows you to rank Canada alongside any other country you care to mention. You can rank emissions per capita and in all sorts of other ways. (see graphic at the bottom)

Walter Bauer writes:

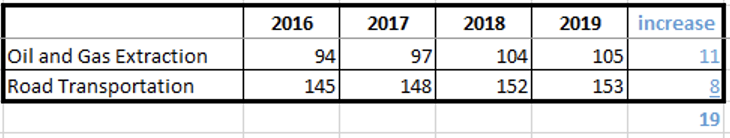

"Canada’s baseline GHG emissions in 2005 were: 739 Mt/year and in 2016 (start of Liberal climate plans): 707 Mt/year. The reduction was primarily due to Ontario’s closing of coal-fired stations in 2014.

In his interview with CBC’s “The House”, Jonathan Wilkinson (Liberal Environment Minister) falsely took credit for early Ontario reductions and repeatedly referenced:

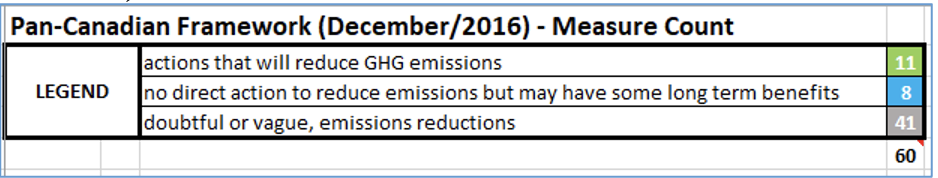

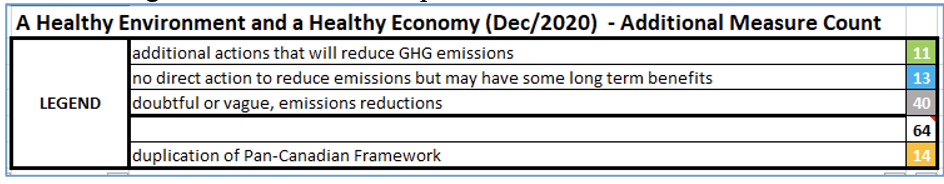

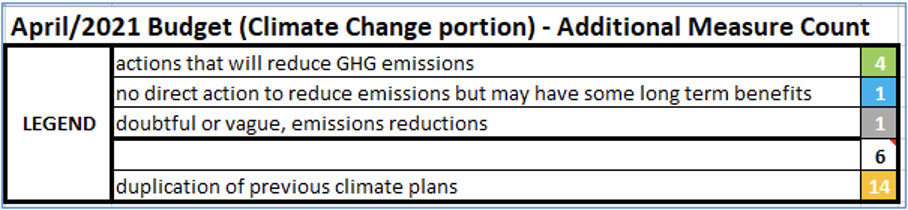

“sixty measures in the Pan-Canadian framework and an additional sixty-four in the Strengthened Climate Plan”.

Numbers are deceiving.

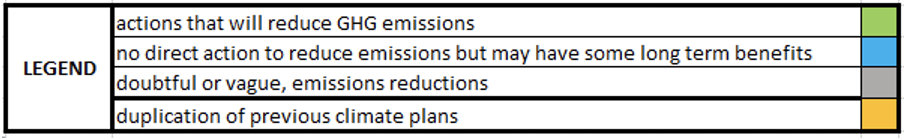

Through two climate plans and budget, the Liberals have introduced measures to counter Climate Change. This analysis subjectively divides the Liberal measures into four primary categories.

The focus of this review is any measure targeting a reduction in GHG emissions (green). Blue includes initiatives such as revised building codes or establishing standards. Grey includes Adaptation and Mitigation, Research & Development or vague commitments.

Pan-Canadian Framework (December 9/2016):: Goal, 511 Mt/year (30% below 2005 levels)

There were only eleven key measures (not 60) to reduce GHG emissions: $7.4 billion/year for 11 years.

GHG Emission Results as of 2019:

If the Pan-Canadian Framework had been effective, by 2019, Canada should have reduced its emissions to approximately 660 Mt/year (assumes linear reduction.) Instead, Canada’s emissions have gone up to 730 Mt/year. Apparently, Canada is the only member of the G-7 nations where emissions increased from 2015-2019. Emissions rose because key Liberal measures had no effect on:

During Question Period in Parliament, Jonathan Wilkinson said:

“2019 will be the last year Canada’s greenhouse gas emissions go up . . . We will see year-on-year reductions — absolute reductions — starting in 2020, through to 2030. We have high confidence that’s actually going to be the case.”

A Healthy Environment and a Healthy Economy (December/2020): Liberals projecting a reduction of emissions to 503 Mt/year (31% below 2005 levels), despite rise from 2016.

Despite the failures of the Pan-Canadian Framework, Canada increased its reduction target with its new climate plan.

There were an additional eleven key additional measures (not 64 additional) to reduce GHG emissions: an additional $2.5 billion/year for an average of 8 years.

Expected GHG Emission Results by 2022: (starting from 730 Mt/year in 2019)

-

-

-

- Temporary drop in GHG emissions in 2020 and 2021 due to pandemic (drop of 51 Mt/year);

- Enbridge Line 3 refurbishment complete in 2021 adding 23 Mt/year over 2019 levels;

- Trans Mountain pipeline will come on line in 2022 adding another 37 Mt/year over 2019 levels;

- Keystone XL pipeline (53 Mt/year) may yet be completed if Biden loses the next election;

- with zero-emission vehicles, even if we reduce emissions by 30% (unlikely), we will only save 50 Mt/year;

- if commercial/institutional and residential retrofits reduceemissions by 20% (unlikely) we will only save another 16 Mt/year; and

- if the Liberal climate plans were effective, by 2022, Canada should have reduced its emissions to approximately 620 Mt/year (16% below 2005 levels assuming linear reduction).Instead, the net result, not counting the temporary drop due to the pandemic or Keystone XL, is a reduction of 6 Mt (23 + 37 – 50 – 16) by 2022 or 724 Mt/year (a reduction of only 2% below 2005 levels.)

-

-

Budget (April 19/2021): Liberals projecting a reduction of emissions to 36% below 2005 levels.

Only three key additional measures to reduce GHG emissions: an additional $0.6 billion for 4 years.

2020 (reported in 2022) and 2021 emissions will show a decrease in GHG emissions but that is largely due to recessionary pressures created by the pandemic.

From 2023 to 2030, it is likely emissions will reduce “year-on-year” due to federal and provincial measures, however, nowhere near the levels required (likely only 10%-15% reduction below 2005 levels, we need 60%.)

Despite negligible GHG reductions to date and grim projections Trudeau announced on 22 April 2021 that Canada will reduce emissions to 40-45% below 2005 levels.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Visit Our World in Data here.

- Details

- Written by Gordon Prentice

It is now over seven months since East Gwillimbury Council asked Metrolinx to consider extending the planned all-day two-way 15 minute train service north from Aurora to the GO Rail station at Green Lane in East Gwillimbury.

The Town Clerk, Fernando Lamanna, told me on 16 April 2021 they still hadn’t heard from Metrolinx. Personally, I consider this a gross discourtesy.

I know Metrolinx has a lot on its plate.

I know we are in the middle of a pandemic but how much effort does it take for someone in Metrolinx to send an email to Mr Lamanna explaining things – or even acknowledging the Town’s request?

Metrolinx could have told Mr Lamanna they are not ready to reply in detail. They could say they have no idea how many people will be using the trains post pandemic. People may feel safer in their own vehicles. I don’t know. But to say nothing is unconscionable.

Quite separately, Metrolinx tell me they need more time to consider my Freedom of Information request (see below) - possibly until 14 July 2021. It will cost me $185. But, even then, there is no guarantee that I will get the information I am after. Metrolinx remind me they can refuse to disclose information to protect

“the economic and other interests of Ontario”.

Why is East Gwillimbury’s initiative important to Newmarket?

If East Gwillimbury (whose MPP is Transportation Minister, Caroline Mulroney) gets a 15 minute train service then we, downstream in Newmarket, automatically get one too. That’s why we should support our neighbour to the north.

Railway Crossing Improvements

In the meantime, Metrolinx is giving us a “railway crossing improvement” at Mulock Drive - one of the busiest roads in Newmarket.

Mulock Drive at the railway tracks will be closed to traffic from Friday, May 7, 2021 at 9 p.m. to Monday, May 10, 2021 at 5 a.m while they do the work.

Instead, we should be getting grade separation now as plans to redevelop the area around the new Mulock Station take shape.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Freedom of Information request to Metrolinx of 25 March 2021: All records (includes internal file notes, notes of meetings, emails or other electronic records) relating to the resolution of East Gwillimbury Council on 22 September 2020 (on the Joint Community Infrastructure & Environmental Services and Development Services Report CIES2020-22), which was forwarded to Metrolinx by the Town Clerk and calls on it to give consideration to: (a) advancing a second Implementation Phase of the GO Expansion Program to extend all-day, two- way, 15-minute service to East Gwillimbury GO Station, and (b) prioritizing the existing Green Lane at-grade rail crossing for grade separation. Time period of the records is 2020/09/23 – 2021/03/20.

Page 77 of 268