Background: Tomorrow (16 February 2017) York Regional Council will rubber stamp the report on the proposed new 2017 Development Charges which will now go out for public consultation with a meeting on 9 March 2017. Then on 18 May 2017 the Regional Council will enact the 2017 Development Charge By-law which comes into effect on 17 June 2017.

Development Charges was the main dish on the menu at last week's Committee of the Whole where members got a detailed presentation from Finance Chief, Bill Hughes. In reserve, is his colossal 352 page Background Study which gives reasons for the proposed policy changes. There are tables, figures and calculations. The Study is available here but, because of its size, it takes ages to load.

Bill Hughes can be counted on to display an effortless mastery of the subject matter. Every sentence uttered is right to the point with no superfluous words or phrases. He often pauses to think before replying to a question - even when the answer is straightforward. It is a theatrical device but effective.

But first we have to listen to Leo Longo, a lawyer, representing Pfaff Porsche who have a complaint about the development charges they are expected to pay. It is all about car parking spaces.

Stranger with a story

I am sitting next to a total stranger and, as a pleasantry, I make some comment about what we are listening to. I ask him if he is here for the development charges debate. He nods.

Are you going to be speaking?

He shakes his head. No.

And with this he thrusts a letter into my hand marked: "To Whom it May Concern". He says if there is anything I can do to help he would appreciate it.

Who on earth does he think I am? Flash Gordon?

The letter tells me he owns and operates a prosperous business in Newmarket. They have 20 full time employees paying good wages. Most live in York Region. Twelve years ago he built a 11,000 sq ft building on which he paid $80,000 in Development Charges and $27,000 in property taxes. His business prospered and now he wants to build another 11,000 sq ft building alongside the first. He says the new Development Charge will be $300,000.

When he bought the land 14 years ago it cost him $320,000

He says the DCs are punitive.

He says

"All tax payers benefit from development and all should pay but you are asking too much from a section of the tax base that is creating jobs and goods and services for the Region."

As I read this, I tell him he should speak directly to councillors but he tells me the letter has already been sent to them - as if there is an equivalence. Now he smiles and gets up to leave - before he has heard the presentation by Bill Hughes. Then again, I suppose he has a business to run. But what a perfect case study for councillors to chew on.

Development Charges not a tax

Anyway... now I am listening to Bill Hughes as he explains the nuts and bolts of Development Charges with great clarity, making a complicated subject a bit easier for the rest of us to understand.

He tells us Development Charges are not a tax. DCs cannot be used to achieve policy objectives in the way that taxes can. DCs, he says, have to "reflect the draw on services".

Of course, the services we all rely on have to be paid for by someone. Personally, I don't mind paying taxes although I appreciate that in the eyes of most people this makes me either a saint or a fool. But taxes have got to be fair and equitable with no cheating allowed. That's my big thing.

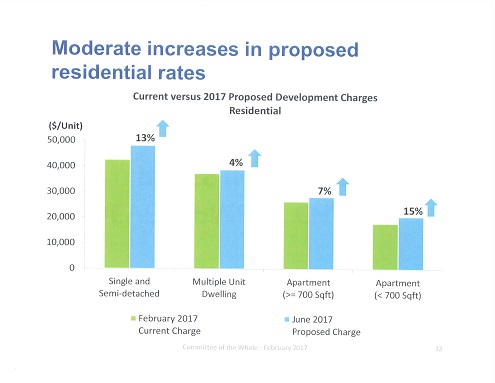

Residential DC rates are going up by (a) 13% for singles and semis to $48,139 (b) 4% for Townhouses to $38,745 (c) 7% for "large" apartments over 700 sq ft to $28,161 and (d) 15% for small apartments under 700 sq ft to $20,555.

For all that, we learn that residential Development Charges represent a declining share of new housing prices.

9,400 new homes every year to 2031

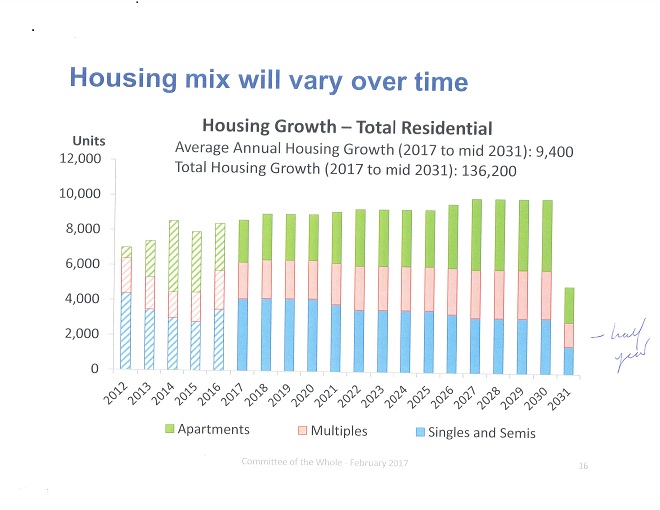

Now he is explaining how the rates are calculated, pointing to the Background Study which provides the detailed justification. Now we are hearing more about projected growth across the Region. 9,400 new residential units every year to 2031 and 12,000 new jobs every year to the same horizon.

The share of DCs coming from non-residential (retail, industrial, office, hotel) have either stayed the same or are falling. Industrial is falling 13%. As I am listening I am thinking about the business in Newmarket facing a $300,000 DC.

A slide tells me:

"The shift to residential will improve the likelihood of realising the development charge collections forecast."

I take this to mean there is a better chance of collecting the cash. But why are the forecasts so out of kilter with reality in the non residential sector? What am I missing? I am sure there is a simple explanation.

So it goes on in great detail and then it is all over.

Fire hose

Markham's Jim Jones speaks for everyone when he says the presentation was

"like drinking from a fire hose".

Everyone is laughing.

The jovial Chair, Wayne Emmerson, is rocking back and forth with mirth.

Now there is much discussion about the 700 sq ft cut-off point between small and "large" apartments. Lots of comments about developers sticking with small apartments at 699 sq ft to save the extra costs of DCs on larger apartments. Frank Scarpitti wants the cut-off raised from 700 sq ft to 1,000 sq ft. Markham's Joe Lee - who says at some point he will down-size - agrees.

Aurora's latest attraction: The No Tell Motel

Now they are on to hotels with a new one opening in Aurora. Mayor Geoff Dawe tells us there is no truth to the rumour it is going to be called the "No Tell Motel".

This is news to me and I am glad the Mayor highlighted the rumour and then took the time to quash it! That's my boy!

Now, as he is winding up, Bill Hughes lets us into a secret.

He tells us he has never forgotten a comment made years ago by Vaughan's Mayor Maurizio Bevilacqua who observed that growth doesn't pay for growth.

Hughes agrees.

Discuss.

This email address is being protected from spambots. You need JavaScript enabled to view it.