Markham's Mayor, the bald baritone, Frank Scarpitti, surprised many last week when he was the sole vote against a proposal to develop a feasibility study which could result in a vacant homes tax for York Region.

Scarpitti, one of the highest paid Mayors in Canada, tells his colleagues on York Region’s Committee of the Whole that a Vacant Property Tax would infringe property rights and could be the thin end of the wedge.

“I mean what is next? If someone owns a cottage in York region and it is sitting empty half the year are we going to start taxing that because it could be used during the winter months to potentially house someone?”

“If someone's an empty nester, a single widow in a single family home, are we going to start saying that's way too much space for someone and they should be taxed because they're not fully (occupying it)?”

His colleagues guffaw when he says this.

He tells them not to laugh.

A Tax to Support Affordable Housing

The staff report recommends that revenues from a Vacant Homes Tax, net of costs, should be earmarked to support affordable housing initiatives. Sounds OK to me.

The report estimates that a 1% - 2% Region-wide Tax could generate between $15M - $90M in gross revenues in the first year although the tax take would be expected to decline in future years as owners sell or rent out their properties rather than keep them empty.

York Region is crying out for more affordable housing.

The Region’s 2020 housing affordability analysis says only 8% of new housing is affordable. The report tells us:

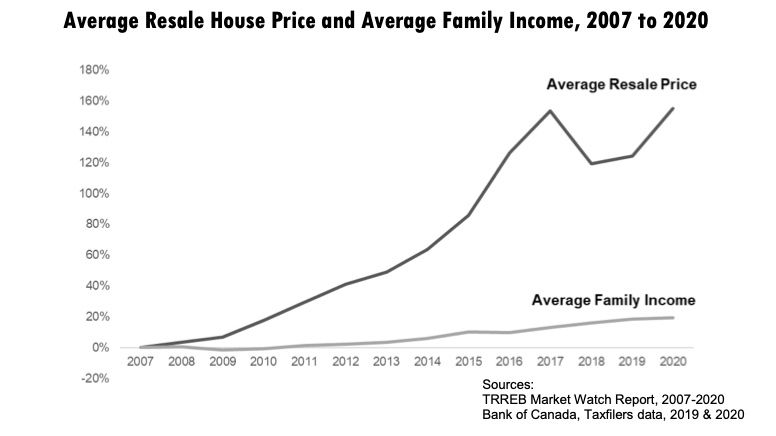

“Housing costs should not exceed 30% of gross income to be affordable. York Region has the highest proportion of households in the GTHA spending over 30% and over 50% of their income on housing costs. One of the key factors impacting housing affordability is that increases to housing prices have far outpaced increases to average incomes. Since 2007 average resale home prices in York Region have increased by over 150% whereas average family income has increased by less than 20%.”

Newmarket is a hotspot

We know that Newmarket is one of the country’s housing hotspots. In 2016 a report in Macleans magazine told us a staggering 20.6% of home sales in Newmarket were purchased as investment properties. It’s old data but I’m pretty sure things haven’t changed that much. Investors from China and from all over the world see Canada as a safe berth for their money. Canada is a stable democracy governed by the rule of law. Why not use property as a store of wealth even if it is kept empty? Frank thinks that's OK.

The one saving grace in Frank’s absurd little speech is his call for development approvals to lapse if they are not acted on:

“I think development approvals should only last for so long. If someone's gonna sit on a draft plan and not build anything for 10 years unless there's some really extraordinary circumstances, they should maybe lose their right, or at least defer their right to build, and let someone else go ahead.”

Development approvals must be acted upon

Why hasn’t he pushed for this before now? He is influential. He hogs the limelight. He has something to say about everything. He is a big beast in the municipal jungle. What is he going to do about it? I’ve been pressing for this for years, with Newmarket examples, but no politician has picked up the ball and run with it.

My advice to Frank is simple enough. Drop your opposition to the Vacant Homes Tax and make the lapsing of development approvals your top priority.

If you do this you may begin to justify your wildly inflated and extravagant salary.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Update on 18 October 2021: In my comments on development approvals I unfairly lumped all politicians together when I wrote that "no politician has picked up the ball and run with it". John Taylor reminds me that he had York Region's 2016 submission to the OMB Review include the concept of a sunset clause for planning approvals. On 5 July 2017 he suggested I follow up with Chris Ballard who was, at that time, MPP for Newmarket-Aurora. He says:

"I may not have run with it as fully as you would have hoped but I did ‘pick it up’ at the very least."

Update on 19 October 2021: from Newmarket Today: York Region taking a closer look at tax on vacant properties.

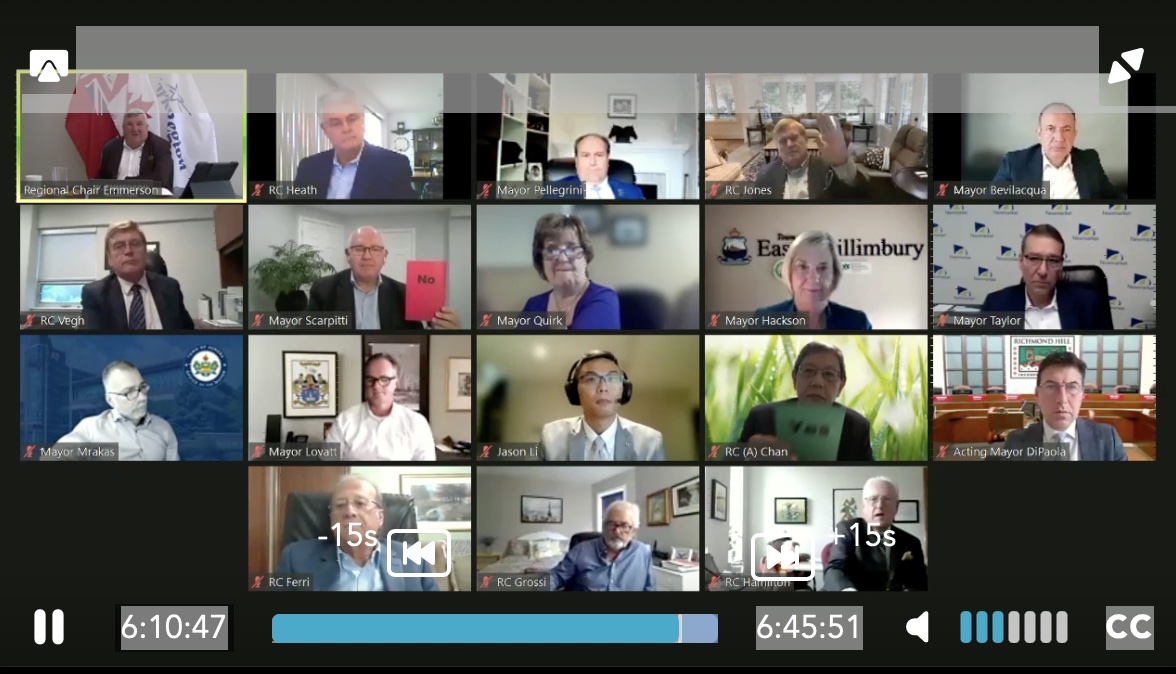

Below: Frank Scarpitti is the only vote against studying the phenomenon of vacant homes and how they might be taxed.

Taxing Vacant Homes debate York Region Committee of the Whole: 14 October 2021

Frank Scarpitti, Markham: This was brought up at the York Region’s housing affordability task force and I would like to express some concerns about this.

I think Councillor Chan (Richmond Hill) made some very good points - have we really assessed what are we chasing here? I don't want to be the dog that's chasing the car that eventually gets tired and realized "why was I chasing it in the first place?"

I don't think we really do understand how big or how small this is. And you know I think some of these things sometimes sound good to the public and let's do this and it somehow is going to resolve or – in a substantive way - resolve the issue of affordable housing. And it’s just like municipalities that rushed to have basement apartments 'cause that was going to contribute to solving the affordable housing (problem).

The reality is it hardly put a dent in it. I don’t even know if it caused a dent in it. And I find that this initiative is much the same way; we're chasing something that we don't know. People have vacant properties for a variety of reasons. Some of them in our municipality are waiting for redevelopment of the property. So if someone says they can turn that around six months in their municipality without having a homeowner being impacted - and they too create jobs and create opportunities for people - I would need to, not that I am not willing to look at it Mr. Chair, I think I’d need to know a lot more about the impacts and effects.

In Vancouver did they just disappear by that amount (the vacant properties)? Did people get around the system? I think it's been said and it’s been said again today and in other discussions that we had on this issue, it is very very tough to monitor; very tough to ascertain truly what is a vacant home versus something else. And, as I said at the task force, I'd much rather focus on initiatives that are going to make a substantive impact on the creation of affordable housing within our communities.

We could do a number of things. But, again, does it really have a substantive impact on getting what we need? And that is more rental units within the region; purposely built secondary suites where they are planned into a community.

And I think homeowners need to wake up to be honest with you. There's a lot of stuff that governments are doing but they're not recognizing it is impacting their properties, their livelihood, their quality of life. And I know some of these things look great on paper. You know, plump down another unit in your backyard. I've lost count on how many complaints and issues we have with a shed, a pool, a cabana you name it. And those are just small utility structures. And so I say these are all things (that) are all good and we made it look a little prettier but did we really solve the problem?

And I for one - if we could - would actually like a presentation from our staff on some of the findings. They’ve obviously done a bit of research and can provide us with a presentation on one of the Thursdays that you have earmarked for education, just so we can find out a little more and understand a little bit more.

If we need a bit of help. I don't know how we do it to ascertain how many vacant properties there are. But I really question the extent that we're going to go (to).

I mean what is next? If someone owns a cottage in York region and it sitting empty half the year are we going to start taxing that because it could be used during the winter months to potentially house someone?

If someone's an empty nester, a single widow in a single family home, are we going to start saying that's way too much space for someone and they should be taxed because they're not fully (occupying it).

I know some of you are laughing but that's the extent of what this is. Let's make no mistake. It is infringing on property rights to a degree that ultimately… I'm not sure that it really puts a substantial dent into the affordable housing issue.

And, as I said at committee, I'd much rather deal with carrots than with sticks to get more affordable housing built. That's where I think we should be putting our efforts. That's where I think most of our return will be. I know you echoed it again Mr Chair at the last committee. I think development approvals should only last for so long. If someone's gonna sit on a draft plan and not build anything for 10 years unless there's some really extraordinary circumstances, they should maybe lose their right, or at least defer their right to build, and let someone else go ahead.

So I think there's other things we can do and many of us are doing it. Local municipalities were doing it. Here at the region, as we know, that's still not enough. We're going to have to get legislative changes provincially to be able to provide greater affordability within our communities. And I’ve spoken to Government officials about that and they are open to that. But I’d rather spend our time, effort and resources on getting the greatest result, the greatest impact in achieving affordable housing within our communities

And you know yeah there might be three or four vacant homes on any given street - not all streets I can tell you that - as I go through a lot of communities.

I have a neighbour... you know you have to realise we do have people, a society that's much more mobile. We have individuals that come back and forth and they live here. They contribute to our local economy (and it) benefits. All the benefits that are derived even from global citizens. And so I really want to know a lot more. And if we need a little bit of help hiring someone with a little bit more expertise (OK) but I wouldn't go (to a) full blown feasibility study.

I want a lot more data that really speaks to, number one, how big really is the problem? And at the end of the day the other part of it for me is how does it really in a substantive way solve the problem? And I only point to this and and it's not the crux of the issue. There are vacant homes for a whole lot of reasons. But it wasn't that long ago that the provincial government said oh we're going to tackle the affordability issue. We're going to put in place a foreign buyers tax. Now we told them that that was a very small percentage of the marketplace to begin with. The tax was put in and how's it going so far? How's it impacted the affordability of homes? And I think we all know the answer to that.

To me, in some respects, unless it truly does reduce the number of vacant homes. But, at the end of the day, I think there are so many other issues that are layered upon this thing - that I think we need to discuss in a much more fulsome way before we embark on feasibility study and spend a whole lot of money.

If we need a bit of expertise I'm OK with that but I cannot support a full blown feasibility study till we get a much better understanding of what this is all about.

I don't want to put window dressing on anything and I know some of you are going to look at the revenue that was generated. You know what, again at the end of the day, I would want to understand how that was executed in those jurisdictions and the ways that people can get around these rules. I am sure if we look a little deeper in some of those communities I'm sure people have found ways to get around some of those rules.

I’ll leave it at that for now. I could support this being this referred to an education session where staff could make a more fulsome presentation and we can understand the different elements of it - include including property rights.

I think we need to hear from some of our legal staff on this. That's fine. Provincial legislation was passed but I think, as time goes on, when the rubber hits the road, we're starting to see how some communities and individuals are starting to react when some of this policy actually gets implemented.

I'll leave it at that.

Regional Chair, Wayne Emmerson: All the team is asking that we develop a feasibility study and maybe come back to council. We can make a presentation always asking if you're interested in doing that. If not turn it down now.

Iain Lovatt (Whitchurch Stouffville): If this is voted down this afternoon is there an opportunity for local municipalities pick this up?

Staff: I believe this has to be policy led by the upper tier municipality (which will do) the policy framework and levy a tax leaving the locals to do the administration of it. We cannot have a nine different tax policies

Mayor Lovatt: I spoke about this issue in our task force meeting. I think all of our challenges are unique in our municipalities. and certainly in Whitchurch Stouffville we're seeing a lot of homes in our built heritage inventory that are being bought. They're being boarded up and they are left to basically fall apart and beyond repair. And the owners will then come and ask for demolition permit and asked be taken off of our heritage inventory because it's beyond repair. And they become eye sores. And we have a number of them across Stouffville Road.

And it's a play for people to just not have to maintain it. And there's probably about 10 homes I can think of where people could be living if they were kept up to date and they haven't been. And now they are falling over. And this is an instrument that my council has been talking about. If people are going to put it families in them I'm all for it but that has not been our experience. And we're paying for it and they are eye sores on the way into our municipality.

So I am supportive of feasibility study and if there was a way that we can do it locally - if it doesn't go this way up at the region - I wish there would be.

Because we would certainly be all over it in Whitchurch Stouffville.

Regional Chair, Wayne Emmerson: The motion is to develop a feasibility study.

John Taylor, Newmarket: I support this. A feasibility study will give us all the information to have informed debate. I look forward to an informed debate and maybe at that time I will finally find out where Frank stands (on this) as well. That’s a joke Frank!

Frank Scarpitti: I’m sorry your Internet cut out just at the punch line (when you mentioned) me. (laughs)

Tom Mrakas, Aurora: We’ve been discussing this at the task force. I'm very supportive of it. We looked at it in Aurora. Ultimately I think that there is no magic solution -one solution to affordable housing. I think there's many pieces in the puzzle and I think this is just another piece of that puzzle.

It's a tool that would be helpful to us as we continue down this path and I'm looking forward to getting all that information and , as Mayor Taylor mentions, having a full debate on this.

(When we talk about) creating affordable housing it seems like the only thing that I would ever talk about is just creating more supply. I don't think that developing communities with $1,000,000 homes is going to create affordability. And so that’s one of these things that we need to do. There is no one one solution. We are all different and as I mentioned at the task force I wish that the Province would give us the authority to look at that commercial properties to enable us to put this (vacant property tax) on those properties.

Because there are a lot of things happening where people are buying up properties and letting them sit vacant and (we are seeing) demolition by decay. And it is unacceptable. And it is what is holding our communities back. So I am in favour of this.

CHECK AGAINST DELIVERY