I do not know if Conrad Black still lives here in Canada – the country whose citizenship he renounced in 2001 and the one which gave him sanctuary after his release from prison in the United States where he had been convicted of fraud.

However, I know for a fact that Black is a member of the UK Parliament and, as such, is deemed to be resident and domiciled in the UK for tax purposes. Black is currently on leave of absence but the tax rules still apply.

When I recently asked him if he satisfied the requirements for membership of the UK Parliament or if he was there under false pretences he told me:

“Of course I am fully qualified to hold the status I do.”

Guidance

Guidance from Her Majesty’s Revenue and Customs (HMRC) says this:

“Members of the House of Commons (MPs) and House of Lords (Peers) are treated as resident and domiciled in the UK for Income Tax, Inheritance Tax and Capital Gains Tax purposes. This applies to the whole of each tax year in which a person is a member of either House. It applies even if that person is a member for only part of the tax year and regardless of whether or not they are on a leave of absence.” (my underlining)

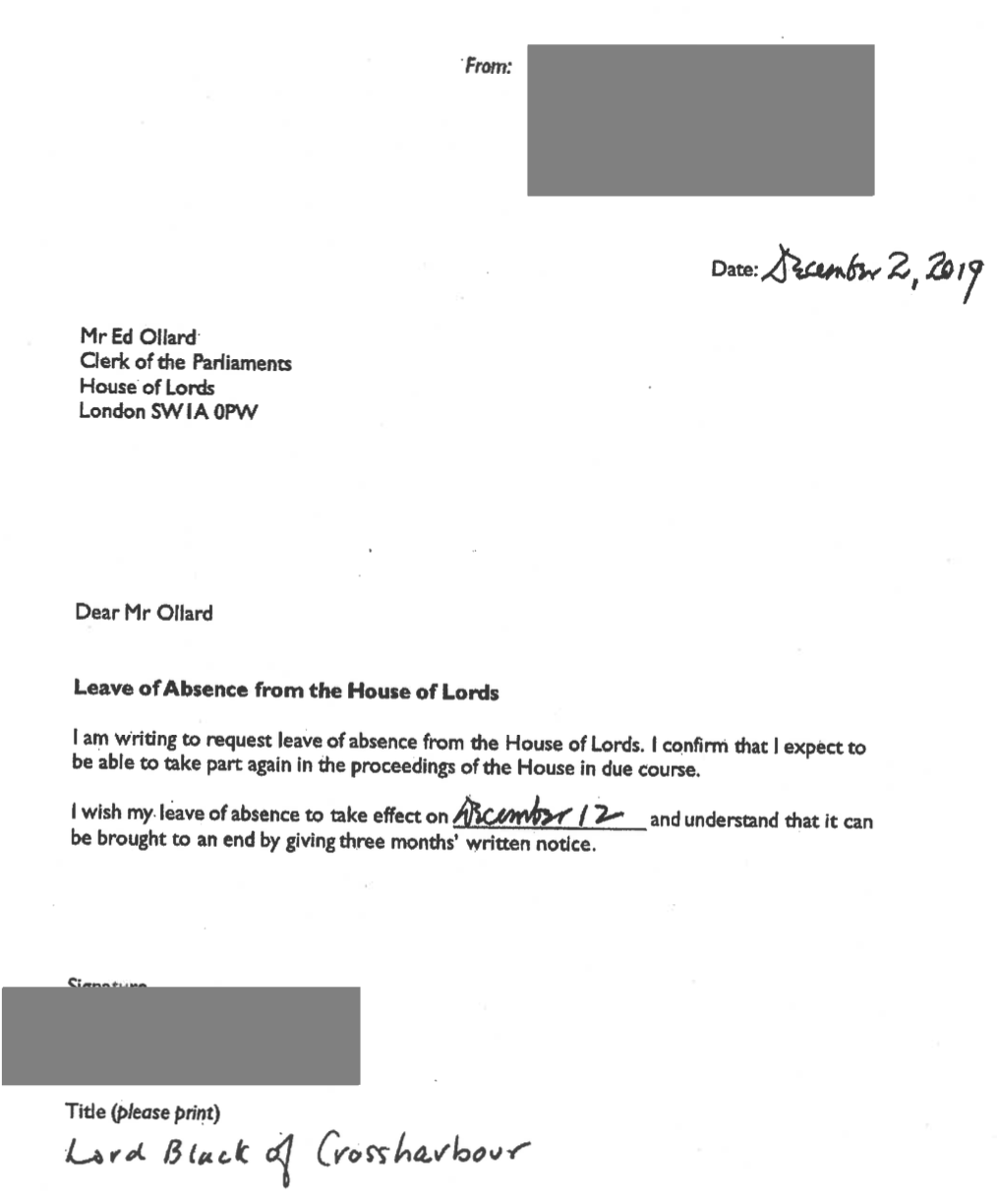

At the start of a new Parliament, the Clerk of the Parliaments writes to peers on leave of absence to ask whether they wish to retire from the House of Lords or whether they plan to attend again but wish to continue their leave of absence in the new Parliament.

I'll be back says Black

On 2 December 2019, Black told the then Clerk of the Parliaments, Ed Ollard, he expected to be able to take part again in the proceedings of the House in due course and wished to stay on leave of absence.

Tax – and especially international taxation - is notoriously complex but, on the face of it, Black should be a UK taxpayer.

As it happens, 13 years ago when I was an MP at Westminster, I introduced the Disqualification from Parliament (Taxation Status) Bill which, unfortunately, failed to make progress. The Government, though, endorsed the general principle that UK Members of Parliament should be expected to pay UK taxes and this was subsequently brought into law with the Constitutional Reform and Governance Act 2010.

Part 4 of the Act provides that Members of Parliament and members of the House of Lords (other than Lords Spiritual) are to be deemed to be resident, ordinarily resident and domiciled in the United Kingdom for the purposes of income tax, capital gains tax and inheritance tax. As a result, MPs and Lords are liable to pay these taxes in the UK on their worldwide income.

That seems clear enough.

Home is where the heart is

Although we must tread carefully through the complexities, it seems HMRC will treat you as UK resident if you spend 183 or more days in the UK in the tax year; have a home in the UK, and do not have a home overseas and work full-time in the UK over a period of 365 days.

Of course, it is not quite so cut and dried. There is now a Statutory Residence Test which takes into account the amount of time you spend in the UK and the connections you have with the UK.

Additionally, we learn:

‘Ordinary residence’ is different from ‘residence’. It is not defined in tax law and is based on cases heard by the Courts. If you’re resident in the UK year after year, this would indicate that you normally live here and you’re therefore ‘ordinarily resident’ here.

As a general rule, HMRC regards you as domiciled in the country where you have your permanent home and

“For the purpose of the Statutory Residence Test we consider that a person’s home is a place that a reasonable onlooker with knowledge of the material facts would regard as that person’s home.”

Is Black here? Or is it a hologram?

I’ve been following Conrad Black’s pronouncements and declamations in the National Post and elsewhere ever since he was released from jail in the United States and I've always taken it as a given that the great man was here amongst us, pontificating in Canada.

Who knows? He wants the UK authorities to believe that all along he has been domiciled in the UK, dutifully paying his taxes to the Exchequer. But, then again, perhaps he has been living here and paying UK taxes!

The House of Lords authorities do not require peers to confirm in writing that they are resident, ordinarily resident and domiciled in the UK for tax purposes. They take it on trust. This is engagingly quaint. But it is also a glaring loophole.

Don't ask. Don't tell

The people who do know - the tax authorities – do not comment on the tax affairs of individuals.

The House of Lords won’t ask. And HM Revenue and Customs won’t tell.

Clearly, the UK Parliamentary authorities should ask peers on leave of absence like Black to confirm in writing that they are UK resident, ordinarily resident and domiciled in the UK for tax purposes and that they fulfil the requirements for membership of the UK legislature.

I wouldn’t take anything on trust from someone with a criminal record.

So why should the UK Parliament?

This email address is being protected from spambots. You need JavaScript enabled to view it.